West Pharmaceutical Services (NYSE: WST) designs and produces containment and delivery systems for injectable drugs and healthcare products. The company operates two segments:

- Proprietary Products offers different solutions for the needs of injectable drug applications, administration systems that enhance the safe delivery of drugs, and drug containment solutions. This segment serves biologic, generic, and pharmaceutical drug companies.

- Contract-Manufactured Products is involved in the design, manufacture, and automated assembly of devices used in surgical, diagnostic, ophthalmic, injectable, and other drug delivery systems, as well as consumer products. It serves pharmaceutical, diagnostic, and medical device companies.

| Segment | 2020 Revenue (USD billions) | Revenue % |

| Proprietary Products | 1.65 | 77% |

| Contract-Manufactured Products | 0.50 | 23% |

WST’s revenues are geographically diversified with 52% of sales coming from outside the U.S.

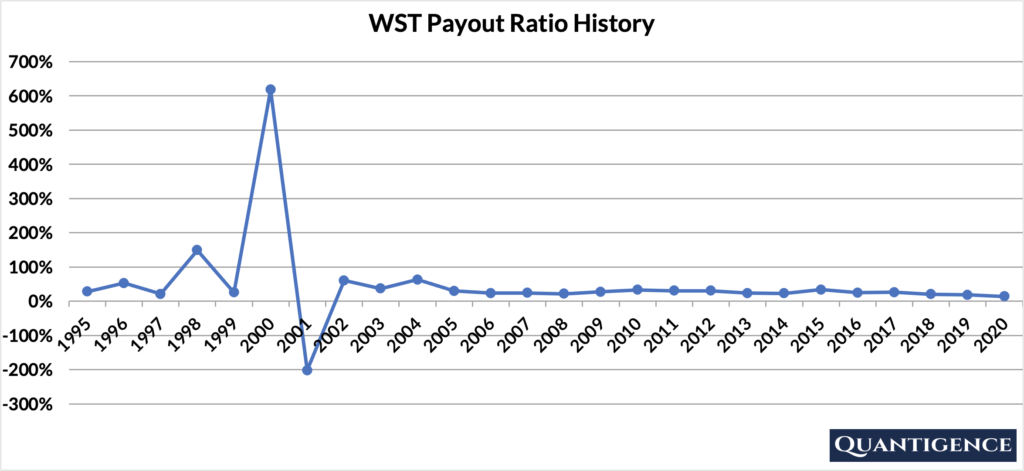

WST’s Dividend History and Payout Ratio

WST has a track record of paying and increasing dividends for 28 consecutive years, making it a relative newcomer to the prestigious club of dividend champions (companies that have been increasing their dividend for more than 25 years in a row). In 2020, the company paid out only 14% of its profits in the form of dividends. This low payout ratio enables the company to keep growing its dividend in the future, even if earnings are not growing or temporarily declining.

In looking at the company’s payout ratio history over the past 25 years, it’s been quite stable (with the notable exception of 2000-2001) with an average of 48%. In 2000-2001, WST incurred costs through a restructuring that decreased its earnings significantly, even into the red in 2001.

When Does WST Pay Dividends?

WST pays a quarterly dividend typically announced on various dates in February, May, July, and December. The ex-dates are in the second half of April, July, October, and January, and payments are made in the first week of the following months (May, August, November, and February).

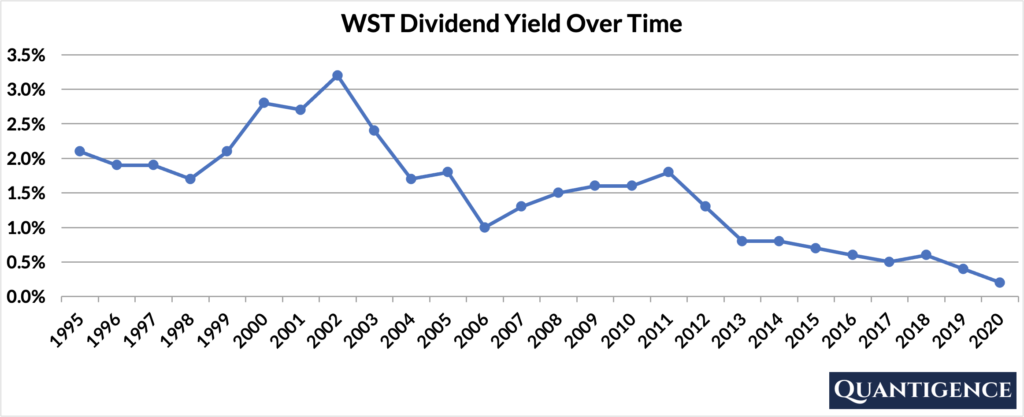

What is WST’s Dividend Yield?

Dividend yield (the annual dividend paid divided by the share price) shows the 1-year income for a stock from dividends. In 2020, WST had a dividend yield of 0.2%, a historical low that is a fraction of our investment universe average of 1.8%. The stock’s historical yield has been moving between 0.2% and 3.2% with an average of 1.5%.

WST’s Dividend Growth Rate

WST has grown its dividend by an average of 7.2% every year for the past 10 years. That growth rate seems to be increasing slightly with the annual average being 7.6% over the last five years. Below you can see the effect a 10-year growth rate of 7.2% has on WST’s dividend assuming a starting yield of 0.2%.

| Years | Dividend Growth | Yield Calculation | Yield % |

| Year 0 | 0% | 0.20% | 0.2% |

| Year 1 | 7.20% | 0.2%*1.072 | 0.21% |

| Year 2 | 7.20% | 0.2%*(1.072)^2 | 0.23% |

| Year 3 | 7.20% | 0.2%*(1.072)^3 | 0.25% |

| Year 4 | 7.20% | 0.2%*(1.072)^4 | 0.26% |

| Year 5 | 7.20% | 0.2%*(1.072)^3 | 0.28% |

| Year 6 | 7.20% | 0.2%*(1.072)^6 | 0.30% |

| Year 7 | 7.20% | 0.2%*(1.072)^7 | 0.33% |

| Year 8 | 7.20% | 0.2%*(1.072)^8 | 0.35% |

| Year 9 | 7.20% | 0.2%*(1.072)^9 | 0.37% |

| Year 10 | 7.20% | 0.2%*(1.072)^10 | 0.40% |

If you bought WST at a yield of 0.2%, an average 10-year dividend growth of 7.2% would mean your yield would be a meagre 0.4% 10 years from now. This is called “yield on cost,” and shows the yield you’re receiving on the original amount of money you invested.

How Strong is WST’s Dividend?

When evaluating dividend stocks, we use our own methodology which is based on Q-scores which consist of seven factors:

- Years paying and increasing dividends

- Market cap

- International sales

- Yield

- Payout ratio

- Five-year dividend growth rate

- Ten-year dividend growth rate

We calculate each of these factors and summarize them in a final proprietary Q-score. To learn more about how we calculate Q-scores, check out our piece on “7 Factors Used to Select Dividend Growth Stocks.”

The Q-score for West Pharmaceutical Services is presently 12.7, the lowest Q-score in the health care sector consisting of five dividend champions. We reward WST for its low payout ratio and international sales. We penalize it for its extremely low yield. The other factors contribute smaller amounts to the company’s final Q-score.

With four better alternatives in the health care sector, we do not include West Pharmaceutical Services in our final 30-stock dividend growth portfolio.

[optin-monster slug=”ziwrnabndtepsyq0fyai”]