Chevron Corporation (NYSE: CVX) engages in integrated energy, chemicals, and petroleum operations worldwide. The company operates two segments:

- The Upstream segment is involved in the exploration, development, and production of crude oil and natural gas

- The Downstream segment engages in refining crude oil into petroleum products, and marketing and transporting crude oil, refined products, and lubricants. It is also involved in cash management and debt financing activities, insurance operations, real estate activities, and technology businesses.

| Segment | 2020 Revenue (USD billions) | Revenue % |

| Upstream | 26.31 | 28% |

| Downstream | 68.08 | 72% |

CVX’s revenues are diversified geographically with 56% of sales coming from outside the U.S.

CVX’s Dividend History and Payout Ratio

CVX has a track record of paying and increasing dividends for 34 consecutive years, a record that the company will feel highly obligated to maintain. In 2020, the company posted losses and curtailed its stock repurchase program in order to pay an increasing dividend and protect its status as a dividend champion.

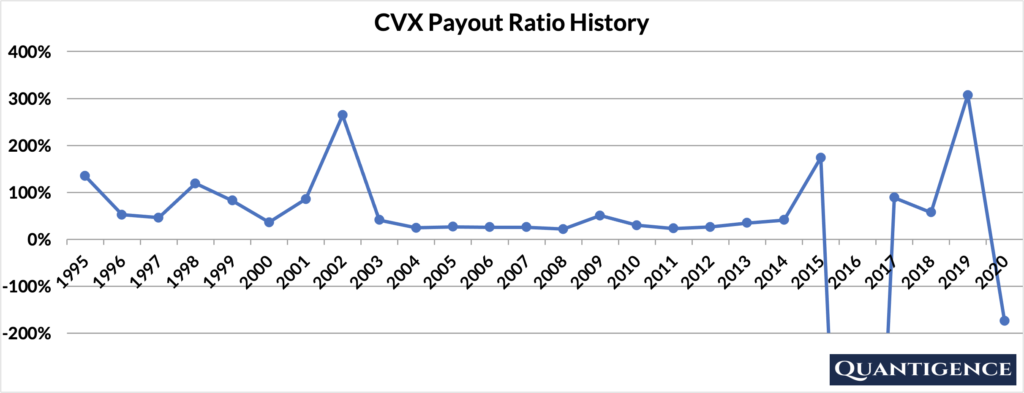

In looking at the company’s payout ratio history over the past 25 years, it’s been quite volatile with many years exceeding 100% and two years of negative payout ratio in 2020 and 2016 when CVX posted losses. In both these years, the price of oil dropped and the Upstream segment, being very sensitive to oil prices, pushed CVX’s earnings into the red.

When Does CVX Pay Dividends?

CVX pays a quarterly dividend typically announced in the last week of January, April, July, and October. The ex-dates are usually around the middle of the following month and payments are made around the 10th of March, June, September, and December.

What is CVX’s Dividend Yield?

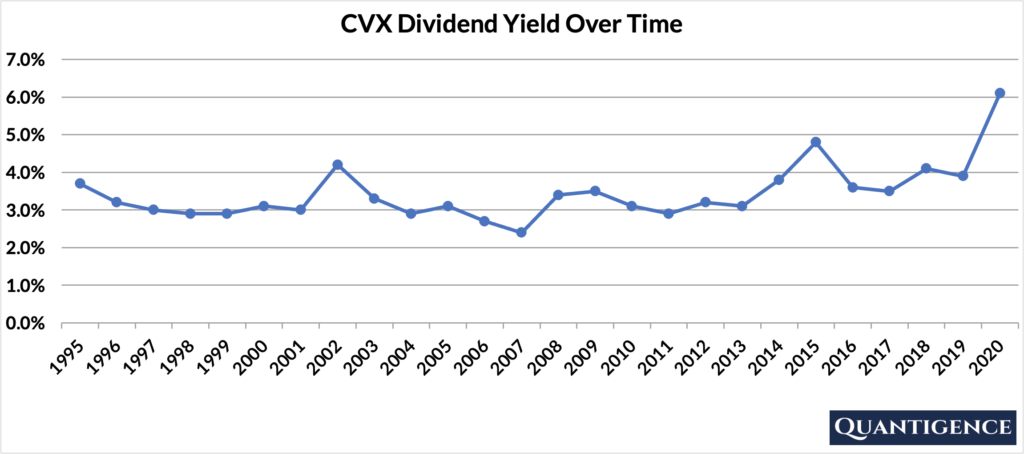

Dividend yield (the annual dividend paid divided by the share price) shows the 1-year income for a stock from dividends. In 2020, CVX had a record dividend yield of 6.1%, more than triple that of our investment universe average of 1.8%. The stock’s historical yield has been moving between 2.4% and 6.1% with an average of 3.4%.

A high dividend yield is a good thing at first glance, but having a yield this high tells us two things. First, CVX shares are cheap compared to its dividend payments because the risks associated with the company are reflected in the share price. Second, it hints at how unsustainable CVX dividends are over the long term given the volatility of its payout ratio and losses in 2020.

CVX’s Dividend Growth Rate

CVX has grown its dividend by an average of 6.2% every year for the past 10 years. That growth seems to be slowing with the annual average being 3.8% over the last five years. Below you can see the effect a 10-year growth rate of 6.2% has on CVX’s dividend assuming a starting yield of 6.1%.

| Years | Dividend Growth | Yield Calculation | Yield % |

| Year 0 | 0% | 6.10% | 6.10% |

| Year 1 | 6.20% | 6.1%*1.062 | 6.48% |

| Year 2 | 6.20% | 6.1%*(1.062)^2 | 6.88% |

| Year 3 | 6.20% | 6.1%*(1.062)^3 | 7.31% |

| Year 4 | 6.20% | 6.1%*(1.062)^4 | 7.76% |

| Year 5 | 6.20% | 6.1%*(1.062)^3 | 8.24% |

| Year 6 | 6.20% | 6.1%*(1.062)^6 | 8.75% |

| Year 7 | 6.20% | 6.1%*(1.062)^7 | 9.29% |

| Year 8 | 6.20% | 6.1%*(1.062)^8 | 9.87% |

| Year 9 | 6.20% | 6.1%*(1.062)^9 | 10.48% |

| Year 10 | 6.20% | 6.1%*(1.062)^10 | 11.13% |

If you bought CVX at a yield of 6.1%, an average 10-year dividend growth of 6.2% would mean your yield would be 11.13% 10 years from now, an outstanding yield by all accounts. This is called “yield on cost,” and shows the yield you’re receiving on the original amount of money you invested.

How Strong is CVX’s Dividend?

When evaluating dividend stocks, we use our own methodology which is based on Q-scores which consist of seven factors:

- Years paying and increasing dividends

- Market cap

- International sales

- Yield

- Payout ratio

- Five-year dividend growth rate

- Ten-year dividend growth rate

We calculate each of these factors and summarize them in a final proprietary Q-score. To learn more about how we calculate Q-scores, check out our piece on “7 Factors Used to Select Dividend Growth Stocks.”

The Q-score for Chevron Corporation is presently 15.1, the worst Q-score in the energy sector consisting of three dividend champions. We reward CVX for its size, yield, and international sales. We penalize it for its payout ratio and low five-year dividend growth rate. The company’s 10-year dividend growth rate and dividend growth track record contribute a smaller amount to the overall Q-score.

We decided to include Chevron Corporation in our final 30-stock dividend growth portfolio because it is a large energy player that can benefit from economies of scale, similarly to Exxon (XOM).

[optin-monster slug=”ziwrnabndtepsyq0fyai”]