Federal Realty Investment Trust (NYSE: FRT) is a leading real estate investment trust (REIT) that owns, operates, and redevelops high-quality retail-based properties located primarily in major coastal markets from Washington, D.C. to Boston as well as San Francisco and Los Angeles. Founded in 1962, Federal Realty’s mission is to deliver long-term, sustainable growth through investing in densely populated, affluent communities where retail demand exceeds supply. Federal Realty’s 101 properties include approximately 2,800 commercial and 2,700 residential leases on 23.4 million square feet. No single commercial or residential property accounted for over 10% of FRT’s 2020 revenue. The company operates only in the U.S. and reports its financials under a single segment.

FRT’s Dividend History and Payout Ratio

FRT has a track record of paying and increasing dividends for 53 consecutive years, the longest record in the REIT industry. This dividend growth track record makes Federal Realty a dividend king (a company that has a track record of increasing dividend payouts for more than 50 years), the most prestigious dividend growth category there is.

When looking at REITs for the purposes of Q-score calculation, we assign a zero Q-score

component for payout ratio because REITs are mandated to distribute all their revenues to shareholders. Hence, REITs are neither penalized nor rewarded for their payout ratio.

When Does FRT Pay Dividends?

FRT pays a quarterly dividend typically announced on various dates in February, May, August, and November. The ex-dates are in March, June, September, and December, and payments are made in the middle of the following months (April, July, October, and January).

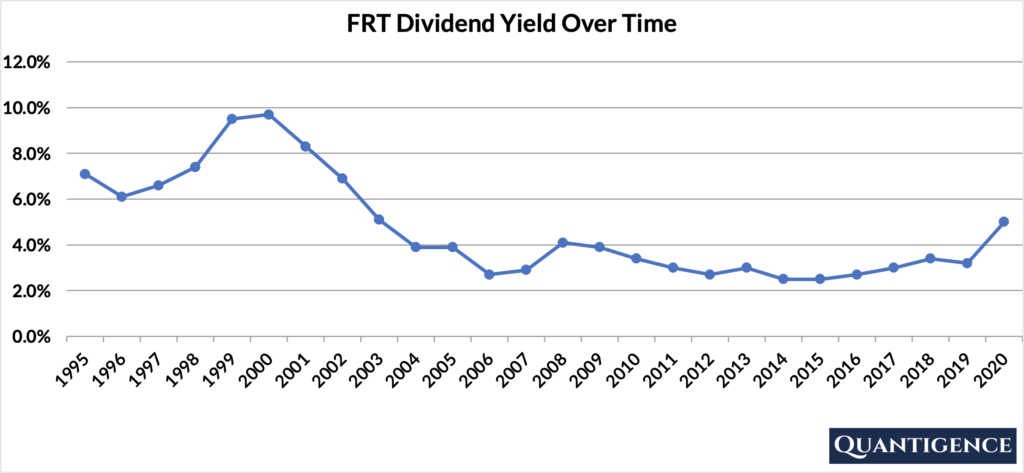

What is FRT’s Dividend Yield?

Dividend yield (the annual dividend paid divided by the share price) shows the 1-year income for a stock from dividends. In 2020, FRT had a dividend yield of 5.0%, close to three times that of our investment universe average of 1.8%. The stock’s historical yield has been moving between 2.5% and 9.7% with an average of 4.7%.

FRT’s Dividend Growth Rate

FRT has grown its dividend by an average of 4.7% every year for the past 10 years. That growth rate seems to be decreasing lately with the annual average being 3.1% over the last five years. Below you can see the effect a 10-year growth rate of 4.7% has on FRT’s dividend assuming a starting yield of 5.0%.

| Years | Dividend Growth | Yield Calculation | Yield % |

| Year 0 | 0% | 5.00% | 5.0% |

| Year 1 | 4.70% | 5.0%*1.047 | 5.24% |

| Year 2 | 4.70% | 5.0%*(1.047)^2 | 5.48% |

| Year 3 | 4.70% | 5.0%*(1.047)^3 | 5.74% |

| Year 4 | 4.70% | 5.0%*(1.047)^4 | 6.01% |

| Year 5 | 4.70% | 5.0%*(1.047)^3 | 6.29% |

| Year 6 | 4.70% | 5.0%*(1.047)^6 | 6.59% |

| Year 7 | 4.70% | 5.0%*(1.047)^7 | 6.90% |

| Year 8 | 4.70% | 5.0%*(1.047)^8 | 7.22% |

| Year 9 | 4.70% | 5.0%*(1.047)^9 | 7.56% |

| Year 10 | 4.70% | 5.0%*(1.047)^10 | 7.91% |

If you bought FRT at a yield of 5.0%, an average 10-year dividend growth of 4.7% would mean your yield would be 7.91% 10 years from now. This is called “yield on cost,” and shows the yield you’re receiving on the original amount of money you invested.

How Strong is FRT’s Dividend?

When evaluating dividend stocks, we use our own methodology which is based on Q-scores which consist of seven factors:

- Years paying and increasing dividends

- Market cap

- International sales

- Yield

- Payout ratio

- Five-year dividend growth rate

- Ten-year dividend growth rate

We calculate each of these factors and summarize them in a final proprietary Q-score. To learn more about how we calculate Q-scores, check out our piece on “7 Factors Used to Select Dividend Growth Stocks.”

The Q-score for Federal Realty is presently 9.2, the top Q-score in the real estate sector consisting of four dividend champions. We reward FRT for its dividend growth track record and high yield. We penalize the company for its low five-year dividend growth rate. Size and 10-year contribute little to the final Q-score and payout ratio and international sales are set to zero (neither rewarded nor penalized) because of the nature of the REIT business. As the top choice in the real estate sector, FRT is included in our final 30-stock dividend growth portfolio.

[optin-monster slug=”ziwrnabndtepsyq0fyai”]