Becton, Dickinson and Company (NYSE: BDX) develops, manufactures, and sells medical supplies, devices, laboratory equipment, and diagnostic products worldwide. The company operates through three segments:

- The Medical segment offers peripheral intravenous (IV) and advanced peripheral catheters, vascular care products, drug transfer devices, hazardous drug detection, hypodermic syringes and needles, IV fluids, and other medical hardware and drug delivery systems

- The Life Sciences segment provides specimen and blood collection products and systems

- The Interventional segment offers hernia and soft tissue repair, biological and bioresorbable grafts, biosurgery, and other surgical products and instruments

| Segment | 2020 Revenue (USD billions) | Revenue % |

| Medical | 8.68 | 51% |

| Life Sciences | 4.68 | 27% |

| Interventional | 3.76 | 22% |

BDX’s revenues are also diversified geographically with 44% of sales coming from outside the U.S.

BDX’s Dividend History and Payout Ratio

BDX has a track record of paying and increasing dividends for 49 consecutive years, one year away from obtaining the title of dividend king (a company that has a track record of increasing dividend payouts for more than 50 years), the most prestigious dividend growth category there is.

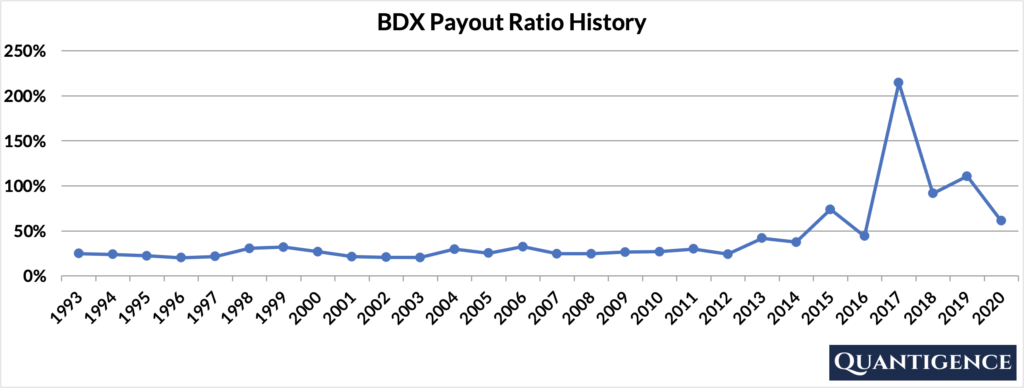

In 2020, the company paid out only 61% of its profits in the form of dividends. This low payout ratio enables the company to keep growing its dividend in the future, even if earnings are not growing or temporarily declining. In looking at the company’s payout ratio history over the past 28 years, it’s been quite stable (with the notable exception of 2017) with an average of 42%.

We see a big spike in the payout ratio of 2017 that can be attributed to new U.S. tax legislation enacted that year that included a comprehensive overhaul of the corporate income tax code. The new law decreased corporate income tax, but also eliminated some tax deductions and introduced new provisions taxing foreign income not previously taxed by the U.S.

The new legislation forced BDX to create provisions for these new tax items from its annual earnings, eliminating $862 million or 73% of its earnings in 2017. As BDX’s earnings decreased, so did its earnings per share. When BDX continued to pay an increasing dividend from a fraction of its earnings, the payout ratio jumped to more than 200% thanks to this one-time change.

When Does BDX Pay Dividends?

BDX pays a quarterly dividend typically announced in the last days of January, April, July, and November. The ex-dates are in the second week of March, June, September, and December, and payments are made on the last day of the same month.

What is BDX’s Dividend Yield?

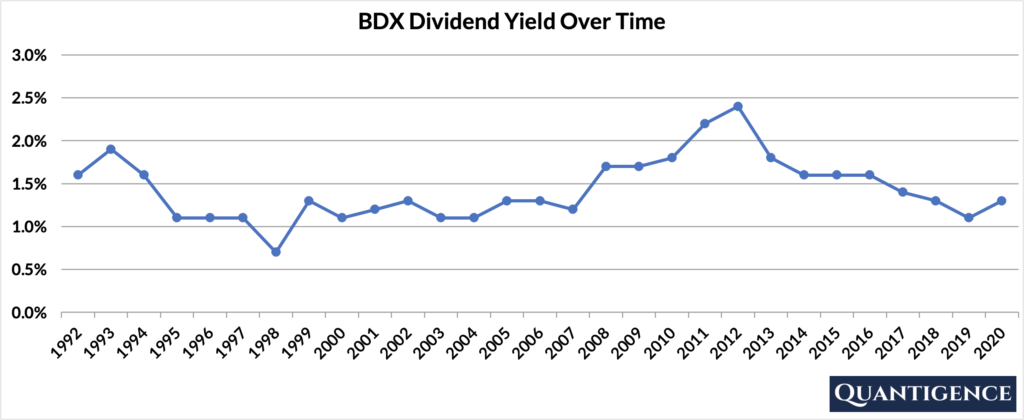

Dividend yield (the annual dividend paid divided by the share price) shows the 1-year income for a stock from dividends. In 2020, BDX had a dividend yield of 1.3%, below our investment universe average of 1.8%. The stock’s historical yield has been moving between 0.7% and 2.4% with an average of 1.4%.

BDX’s Dividend Growth Rate

BDX has grown its dividend by an average of 7.7% every year for the past 10 years. That growth rate seems to be decreasing lately with the annual average being 5.4% over the last five years. Below you can see the effect a 10-year growth rate of 7.7% has on BDX’s dividend assuming a starting yield of 1.3%.

| Years | Dividend Growth | Yield Calculation | Yield % |

| Year 0 | 0% | 1.30% | 1.3% |

| Year 1 | 7.70% | 1.3%*1.077 | 1.40% |

| Year 2 | 7.70% | 1.3%*(1.077)^2 | 1.51% |

| Year 3 | 7.70% | 1.3%*(1.077)^3 | 1.62% |

| Year 4 | 7.70% | 1.3%*(1.077)^4 | 1.75% |

| Year 5 | 7.70% | 1.3%*(1.077)^3 | 1.88% |

| Year 6 | 7.70% | 1.3%*(1.077)^6 | 2.03% |

| Year 7 | 7.70% | 1.3%*(1.077)^7 | 2.19% |

| Year 8 | 7.70% | 1.3%*(1.077)^8 | 2.35% |

| Year 9 | 7.70% | 1.3%*(1.077)^9 | 2.53% |

| Year 10 | 7.70% | 1.3%*(1.077)^10 | 2.73% |

If you bought BDX at a yield of 1.3%, an average 10-year dividend growth of 7.7% would mean your yield would be 2.73% 10 years from now. This is called “yield on cost,” and shows the yield you’re receiving on the original amount of money you invested.

How Strong is BDX’s Dividend?

When evaluating dividend stocks, we use our own methodology which is based on Q-scores which consist of seven factors:

- Years paying and increasing dividends

- Market cap

- International sales

- Yield

- Payout ratio

- Five-year dividend growth rate

- Ten-year dividend growth rate

We calculate each of these factors and summarize them in a final proprietary Q-score. To learn more about how we calculate Q-scores, check out our piece on “7 Factors Used to Select Dividend Growth Stocks.”

The Q-score for Becton, Dickinson and Company is presently 13.4, the third-best Q-score in the health care sector consisting of five dividend champions. We reward BDX for its dividend growth track record and diversified international sales. The company’s size, payout ratio, and five and 10-year dividend growth rates contribute a bit less to its overall Q-score. We penalize BDX for its low yield.

Becton Dickinson is the third dividend champion by Q-score in our health care universe of five. With a small 0.1 difference between BDX and Stryker (SYK) in the fourth position, we decided to stick with SYK as we’ve been holding the company in our portfolio already. Hence, BDX is not included in our final 30-stock dividend growth portfolio.

[optin-monster slug=”ziwrnabndtepsyq0fyai”]