Atmos Energy Corporation (NYSE: ATO) engages in the regulated natural gas distribution, and pipeline and storage businesses in the United States. It operates in two segments, Distribution, and Pipeline and Storage with revenues concentrated in the Distribution segment.

| Segment | 2020 Revenue (USD billions) | Revenue % |

| Distribution | 2.63 | 81% |

| Pipeline and Storage | 0.61 | 19% |

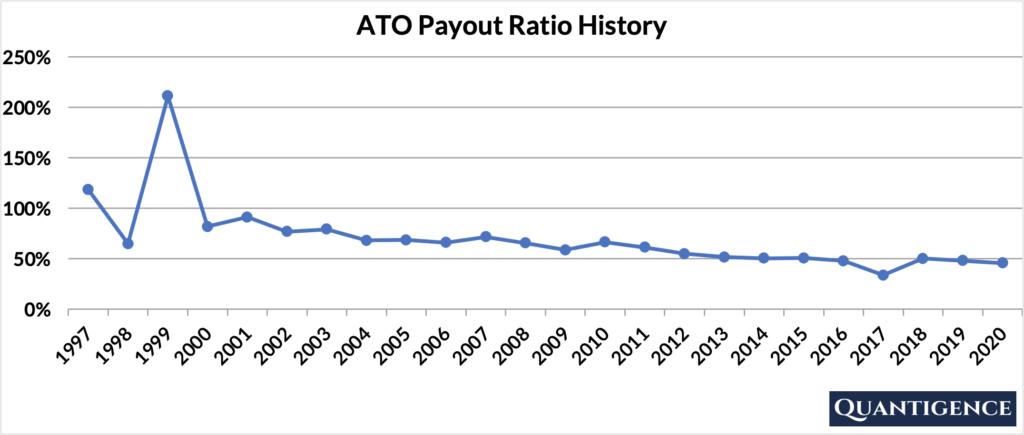

ATO’s Dividend History and Payout Ratio

ATO has a track record of paying and increasing dividends for 37 consecutive years, a record that the company will feel highly obligated to maintain. In 2020, the company paid out only 46% of its profits in the form of dividends. This low payout ratio enables the company to keep growing its dividend in the future, even if earnings are not growing or temporarily declining.

In looking at the company’s payout ratio history over the past 24 years, it’s been relatively stable with an average of 70%. ATO’s payout ratio spiked above 100% in two years:

- In 1999, the company simply had a bad business year driven by decreased West Texas nonregulated irrigation and industrial revenues

- In 1997, ATO incurred significantly increased operating expenses with revenues remaining flat

When Does ATO Pay Dividends?

ATO pays a quarterly dividend typically announced in the first half of February, May, August, and November. The ex-dates are usually in the third week of the same month, and payments are made in the second week of the following month (March, June, September, and December).

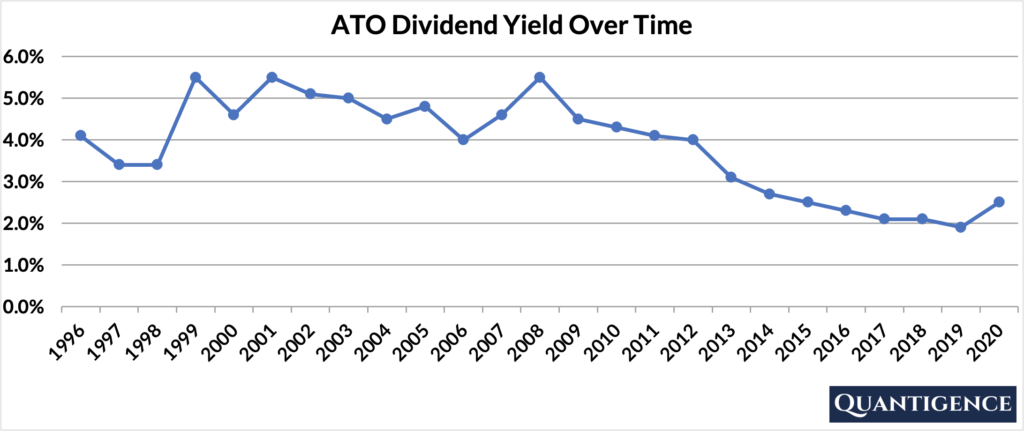

What is ATO’s Dividend Yield?

Dividend yield (the annual dividend paid divided by the share price) shows the 1-year income for a stock from dividends. In 2020, ATO had a dividend yield of 2.5%, higher than our investment universe average of 1.8%. The stock’s historical yield has been moving between 1.9% and 5.5% with an average of 3.8%.

ATO’s Dividend Growth Rate

ATO has grown its dividend by an average of 5.7% every year for the past 10 years. That growth seems to be increasing with the annual average being 8.2% over the last five years. Below you can see the effect a 10-year growth rate of 5.7% has on ATO’s dividend assuming a starting yield of 2.5%.

| Years | Dividend Growth | Yield Calculation | Yield % |

| Year 0 | 0% | 2.50% | 2.5% |

| Year 1 | 5.70% | 2.5%*1.057 | 2.64% |

| Year 2 | 5.70% | 2.5%*(1.057)^2 | 2.79% |

| Year 3 | 5.70% | 2.5%*(1.057)^3 | 2.95% |

| Year 4 | 5.70% | 2.5%*(1.057)^4 | 3.12% |

| Year 5 | 5.70% | 2.5%*(1.057)^3 | 3.30% |

| Year 6 | 5.70% | 2.5%*(1.057)^6 | 3.49% |

| Year 7 | 5.70% | 2.5%*(1.057)^7 | 3.69% |

| Year 8 | 5.70% | 2.5%*(1.057)^8 | 3.90% |

| Year 9 | 5.70% | 2.5%*(1.057)^9 | 4.12% |

| Year 10 | 5.70% | 2.5%*(1.057)^10 | 4.35% |

If you bought ATO at a yield of 2.5%, an average 10-year dividend growth of 5.7% would mean your yield would be 4.35% 10 years from now. This is called “yield on cost,” and shows the yield you’re receiving on the original amount of money you invested.

How Strong is ATO’s Dividend?

When evaluating dividend stocks, we use our own methodology which is based on Q-scores which consist of seven factors:

- Years paying and increasing dividends

- Market cap

- International sales

- Yield

- Payout ratio

- Five-year dividend growth rate

- Ten-year dividend growth rate

We calculate each of these factors and summarize them in a final proprietary Q-score. To learn more about how we calculate Q-scores, check out our piece on “7 Factors Used to Select Dividend Growth Stocks.”

The Q-score for Atmos Energy is presently 11.0, the second-best Q-score in the energy sector consisting of five dividend champions. We reward ATO for its dividend growth track record and low payout ratio. The company’s yield and five and 10-year dividend growth rates are also good and contribute a bit less to the overall Q-score. Because it’s an energy company, we do not take ATO’s international sales into account.

When we chose the energy companies to include in our portfolio, we wanted to hold gas, water, and electric. It so happens that the company with the top Q-score is also a gas company, so we don’t include Atmos Energy in our final 30-stock dividend growth portfolio.

[optin-monster slug=”ziwrnabndtepsyq0fyai”]