Franklin Resources (NYSE: BEN) is a publicly owned asset management holding company. Through its subsidiaries, the firm provides its services to individuals, institutions, pension plans, trusts, and partnerships. It launches and manages equity, fixed income, balanced, and multi-asset mutual funds. The company reports its financials through a single operating segment and its revenues are mainly coming from the U.S.

| Geography | 2020 Revenue (USD billions) | Revenue % |

| United States | 0.63 | 78% |

| Europe, Middle East and Africa | 0.13 | 16% |

| Asia-Pacific | 0.04 | 5% |

| Americas excluding United States | 0.01 | 1% |

BEN’s Dividend History and Payout Ratio

BEN has a track record of paying and increasing dividends for 41 consecutive years, a record that the company will feel highly obligated to maintain. In 2020, the company paid out 70% of its profits in the form of dividends. This payout ratio, though not especially low, still enables the company to keep growing its dividend in the future, even if earnings are not growing or temporarily declining.

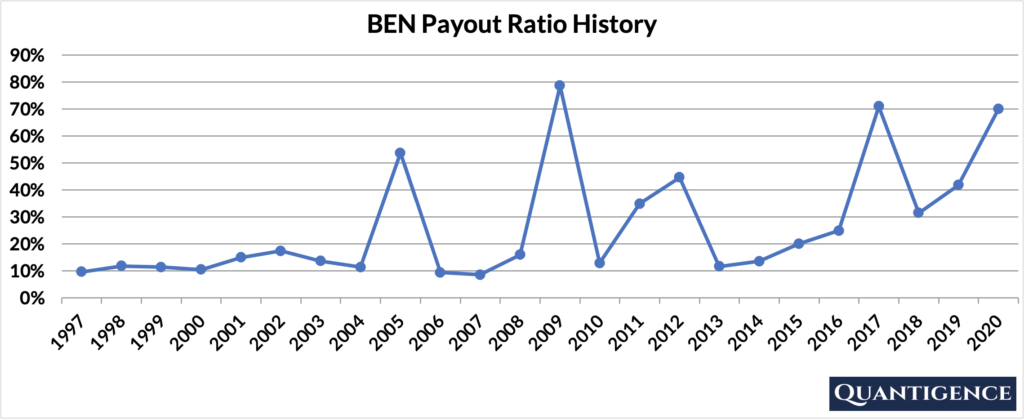

In looking at the company’s payout ratio history over the past 24 years, it’s been relatively volatile but without going over 80%. It has an average of 27% for the period.

In order to calculate BEN’s payout ratio and yield, we deducted a special dividend of $3.0 that the company paid in 2018. We do not take special dividends into account in our Q-score calculations because they do not reflect the long-term ability of dividend champions to grow their dividend.

When Does BEN Pay Dividends?

BEN pays a quarterly dividend typically announced on various dates in February, June, August, and December. The ex-dates are usually close to the end of March, June, September, and December. Payments are made in the second week of the following month (April, July, October, and January).

What is BEN’s Dividend Yield?

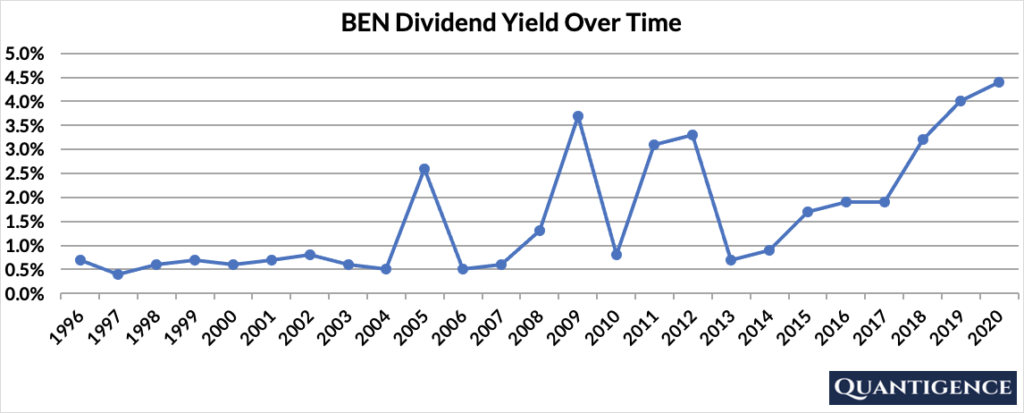

Dividend yield (the annual dividend paid divided by the share price) shows the 1-year income for a stock from dividends. In 2020, BEN had a record dividend yield of 4.4%, more than double that of our investment universe average of 1.8%. The stock’s historical yield has been moving between 0.4% and 4.4% with an average of 1.6%.

BEN’s Dividend Growth Rate

BEN has grown its dividend by an average of 13.7% every year for the past 10 years. That growth seems to be slowing slightly with the annual average being 11.6% over the last five years, which is still an excellent growth rate. Below you can see the effect a 10-year growth rate of 13.7% has on BEN’s dividend assuming a starting yield of 4.4%.

| Years | Dividend Growth | Yield Calculation | Yield % |

| Year 0 | 0% | 4.40% | 4.4% |

| Year 1 | 13.70% | 4.4%*1.137 | 5.00% |

| Year 2 | 13.70% | 4.4%*(1.137)^2 | 5.69% |

| Year 3 | 13.70% | 4.4%*(1.137)^3 | 6.47% |

| Year 4 | 13.70% | 4.4%*(1.137)^4 | 7.35% |

| Year 5 | 13.70% | 4.4%*(1.137)^3 | 8.36% |

| Year 6 | 13.70% | 4.4%*(1.137)^6 | 9.51% |

| Year 7 | 13.70% | 4.4%*(1.137)^7 | 10.81% |

| Year 8 | 13.70% | 4.4%*(1.137)^8 | 12.29% |

| Year 9 | 13.70% | 4.4%*(1.137)^9 | 13.97% |

| Year 10 | 13.70% | 4.4%*(1.137)^10 | 15.89% |

If you bought BEN at a yield of 4.4%, an average 10-year dividend growth of 13.7% would mean your yield would be 15.89% 10 years from now, an outstanding yield by all accounts. This is called “yield on cost,” and shows the yield you’re receiving on the original amount of money you invested.

How Strong is BEN’s Dividend?

When evaluating dividend stocks, we use our own methodology which is based on Q-scores which consist of seven factors:

- Years paying and increasing dividends

- Market cap

- International sales

- Yield

- Payout ratio

- Five-year dividend growth rate

- Ten-year dividend growth rate

We calculate each of these factors and summarize them in a final proprietary Q-score. To learn more about how we calculate Q-scores, check out our piece on “7 Factors Used to Select Dividend Growth Stocks.”

The Q-score for Franklin Resources is presently 16.4, the third-best Q-score in the financials sector consisting of nine dividend champions. We reward BEN for its dividend growth track record, yield, and both five and 10-year dividend growth rates. and low payout ratio. The company’s size, payout ratio, and international sales contribute little to the overall Q-score.

Franklin Resources is a strong dividend champion and we include it as the third financials stock in our final 30-stock dividend growth portfolio.

[optin-monster slug=”ziwrnabndtepsyq0fyai”]