Air Products and Chemicals (NYSE: APD) provides atmospheric gases (including oxygen, nitrogen, argon, and rare gases), process gases (including hydrogen, helium, carbon dioxide, carbon monoxide, syngas), and specialty gases, equipment, and related services worldwide. APD operates through four segments, broken down by geographies:

- Industrial Gases – Americas

- Industrial Gases – EMEA (Europe, Middle East, and Africa)

- Industrial Gases – Asia

- The Industrial Gases – Global segment specifically includes activity related to the sale of cryogenic and gas processing equipment for air separation

- The Corporate and other segment includes liquefied natural gas, turbo machinery equipment and services, and distribution sale of equipment businesses as well as corporate support functions that benefit all segments

| Segment | 2020 Revenue (USD billions) | Revenue % |

| Industrial Gases – Americas | 3.63 | 41% |

| Industrial Gases – Asia | 2.72 | 31% |

| Industrial Gases – EMEA | 1.93 | 22% |

| Industrial Gases – Global | 0.36 | 4% |

| Corporate and other | 0.22 | 2% |

As seen in the table above, APD’s revenues are well diversified geographically.

APD’s Dividend History and Payout Ratio

APD has a track record of paying and increasing dividends for 39 consecutive years, a record that the company will feel highly obligated to maintain. In 2020, the company paid out only 63% of its profits in the form of dividends. This low payout ratio enables the company to keep growing its dividend in the future, even if earnings are not growing or temporarily declining.

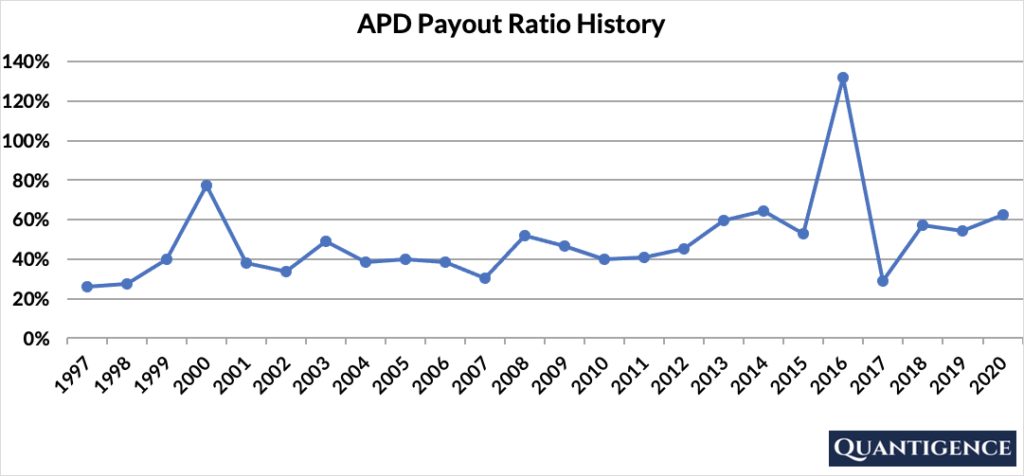

In looking at the company’s payout ratio history over the past 24 years, it’s been relatively stable with an average of 49%. 2016 was the only year where APD’s payout ratio spiked above 100%. This was the year APD spun off its Materials Technologies division into a separate publicly traded entity and incurred one-off costs related to the transaction.

When Does APD Pay Dividends?

APD pays a quarterly dividend typically announced in the second half of January, May, July, and November. The ex-dates are usually at the end of March, June, September, and December, and payments are made on the second week of (May, August, November, and February).

What is APD’s Dividend Yield?

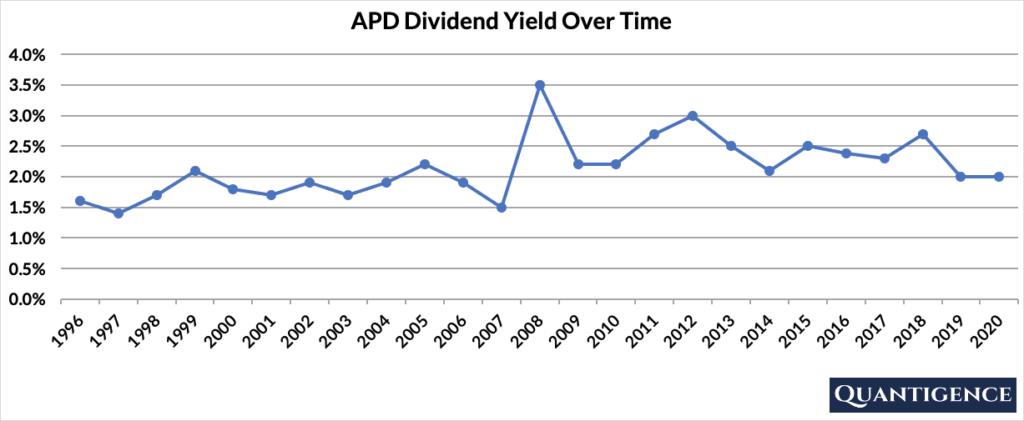

Dividend yield (the annual dividend paid divided by the share price) shows the 1-year income for a stock from dividends. In 2020, APD had a dividend yield of 2.0%, higher than our investment universe average of 1.8%. The stock’s historical yield has been moving between 1.4% and 3.5% with an average of 2.1%.

APD’s Dividend Growth Rate

APD has grown its dividend payout by an average of 10.6% every year for the past 10 years, as well as the last five years, demonstrating stable high growth that well outpaces inflation. Below you can see the effect a 10-year growth rate of 10.6% has on APD’s dividend assuming a starting yield of 2.0%.

| Years | Dividend Growth | Yield Calculation | Yield % |

| Year 0 | 0% | 2.00% | 2.0% |

| Year 1 | 10.60% | 2.0%*1.106 | 2.21% |

| Year 2 | 10.60% | 2.0%*(1.106)^2 | 2.45% |

| Year 3 | 10.60% | 2.0%*(1.106)^3 | 2.71% |

| Year 4 | 10.60% | 2.0%*(1.106)^4 | 2.99% |

| Year 5 | 10.60% | 2.0%*(1.106)^3 | 3.31% |

| Year 6 | 10.60% | 2.0%*(1.106)^6 | 3.66% |

| Year 7 | 10.60% | 2.0%*(1.106)^7 | 4.05% |

| Year 8 | 10.60% | 2.0%*(1.106)^8 | 4.48% |

| Year 9 | 10.60% | 2.0%*(1.106)^9 | 4.95% |

| Year 10 | 10.60% | 2.0%*(1.106)^10 | 5.48% |

If you bought APD at a yield of 2.0%, an average 10-year dividend growth of 10.6% would mean your yield would be 5.48% 10 years from now. This is called “yield on cost,” and shows the yield you’re receiving on the original amount of money you invested.

How Strong is APD’s Dividend?

When evaluating dividend stocks, we use our own methodology which is based on Q-scores which consist of seven factors:

- Years paying and increasing dividends

- Market cap

- International sales

- Yield

- Payout ratio

- Five-year dividend growth rate

- Ten-year dividend growth rate

We calculate each of these factors and summarize them in a final proprietary Q-score. To learn more about how we calculate Q-scores, check out our piece on “7 Factors Used to Select Dividend Growth Stocks.”

The Q-score for Air Products and Chemicals is presently 16.8, which places the company in the top position out of seven dividend champions in the materials sector. We reward APD for its dividend growth track record, international sales, and excellent five and 10-year dividend growth rates. APD’s size, yield, and payout ratio are also good enough and contribute significantly but a little less to its final Q-score. This is why we include APD in our final 30-stock dividend growth portfolio as our top pick in the materials sector.

[optin-monster slug=”ziwrnabndtepsyq0fyai”]