Stanley Black & Decker (NYSE: SWK) engages in the tools and storage, industrial, and security businesses worldwide. It has three reporting segments:

- Tools & Storage offers power tools and equipment, lawn and garden products, and home products for both professionals and consumers

- The Industrial segment provides engineered fastening systems, pipe handling, joint welding, and coating equipment, and hydraulic tools to heavy industry customers

- The Security segment designs, supplies, and installs commercial electronic security systems, offers healthcare solutions, and sells automatic doors to commercial customers

| Segment | 2020 Revenue (USD billions) | Revenue % |

| Tools & Storage | 10.33 | 71% |

| Industrial | 2.35 | 16% |

| Security | 1.85 | 13% |

SWK’s revenues are geographically diversified with 41% of sales coming from outside the U.S.

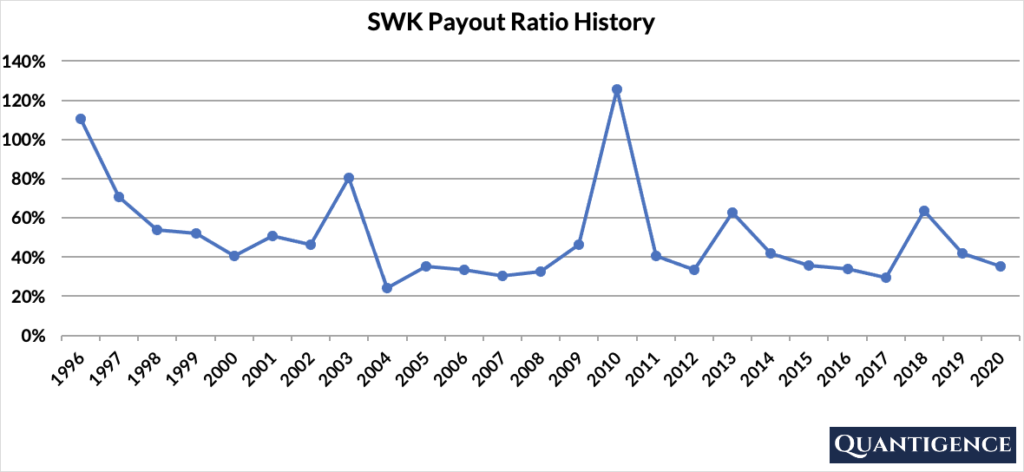

SWK’s Dividend History and Payout Ratio

SWK has a track record of paying and increasing dividends for 53 consecutive years, a record that the company will feel highly obligated to maintain. This dividend growth track record makes SWK a dividend king (a company that has a track record of increasing dividend payouts for more than 50 years), the most prestigious dividend growth category there is.

In 2020, the company paid out only 35% of its profits in the form of dividends. This low payout ratio enables the company to keep growing its dividend in the future, even if earnings are not growing or temporarily declining. In looking at the company’s payout ratio history over the past 25 years, it’s been relatively volatile with an average of 50%.

In both the years where SWK’s payout ratio was above 100%, the increase was driven by one-off restructuring charges:

- In 2010, Stanley merged with Black & Decker and the costs of the merger and subsequent restructuring depressed earnings for the year and drove the payout ratio above 100%

- In 1996, the company implemented a multi-year restructuring plan and incurred one-off charges that reduced its earnings per share by 33%

When Does SWK Pay Dividends?

SWK pays a quarterly dividend typically announced on various dates in February, April, July, and October. The ex-dates are usually at the beginning of March and June, and the end of August and November. Payments are made in the second half of March, June, September, and December.

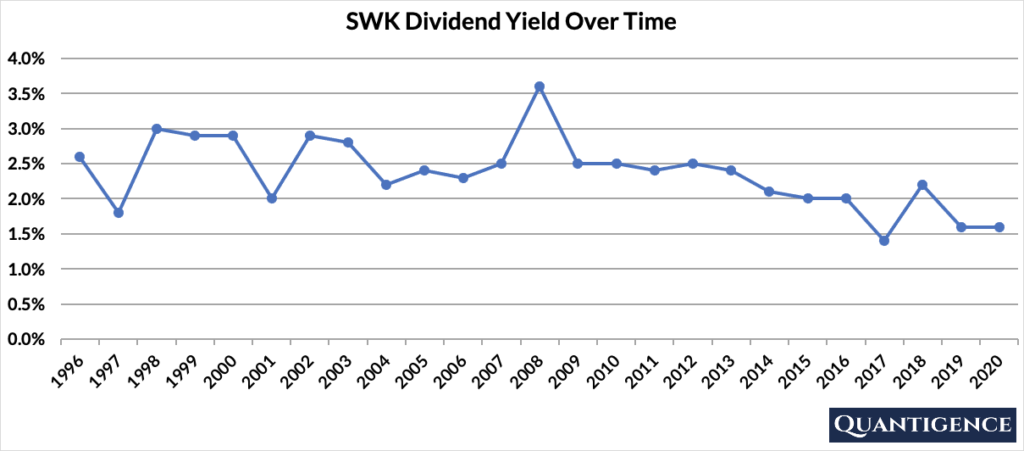

What is SWK’s Dividend Yield?

Dividend yield (the annual dividend paid divided by the share price) shows the 1-year income for a stock from dividends. In 2020, SWK had a dividend yield of 1.6%, below our investment universe average of 1.8%. The stock’s historical yield has been moving between 1.4% and 3.6% with an average of 2.4%.

SWK’s Dividend Growth Rate

SWK has grown its dividend payout by an average of 5.2% every year for the past 10 years, and 5.4% over the last five years, demonstrating stable high growth that outpaces inflation. Below you can see the effect a 10-year growth rate of 5.2% has on SWK’s dividend assuming a starting yield of 1.6%.

| Years | Dividend Growth | Yield Calculation | Yield % |

| Year 0 | 0% | 1.60% | 1.6% |

| Year 1 | 5.20% | 1.6%*1.052 | 1.68% |

| Year 2 | 5.20% | 1.6%*(1.052)^2 | 1.77% |

| Year 3 | 5.20% | 1.6%*(1.052)^3 | 1.86% |

| Year 4 | 5.20% | 1.6%*(1.052)^4 | 1.96% |

| Year 5 | 5.20% | 1.6%*(1.052)^3 | 2.06% |

| Year 6 | 5.20% | 1.6%*(1.052)^6 | 2.17% |

| Year 7 | 5.20% | 1.6%*(1.052)^7 | 2.28% |

| Year 8 | 5.20% | 1.6%*(1.052)^8 | 2.40% |

| Year 9 | 5.20% | 1.6%*(1.052)^9 | 2.53% |

| Year 10 | 5.20% | 1.6%*(1.052)^10 | 2.66% |

If you bought SWK at a yield of 1.6%, an average 10-year dividend growth of 5.2% would mean your yield would be 2.66% 10 years from now. This is called “yield on cost,” and shows the yield you’re receiving on the original amount of money you invested.

How Strong is SWK’s Dividend?

When evaluating dividend stocks, we use our own methodology which is based on Q-scores which consist of seven factors:

- Years paying and increasing dividends

- Market cap

- International sales

- Yield

- Payout ratio

- Five-year dividend growth rate

- Ten-year dividend growth rate

We calculate each of these factors and summarize them in a final proprietary Q-score. To learn more about how we calculate Q-scores, check out our piece on “7 Factors Used to Select Dividend Growth Stocks.”

The Q-score for Stanley Black & Decker is presently 14.7, which places the company in the eighth position out of 16 dividend champions in the industrials sector. We reward SWK for its dividend growth track record, low payout ratio, and its international sales. We do not penalize any factor but the rest (size, yield, and both dividend growth rates) contribute only little to SWK’s final Q-score. With many better alternatives in the same sector, we do not include Stanley Black & Decker in our final 30-stock dividend growth portfolio.

[optin-monster slug=”ziwrnabndtepsyq0fyai”]