McDonald’s Corporation (NYSE: MCD) operates and franchises McDonald’s restaurants globally. Its restaurants offer a menu of carefully selected and nutritionally balanced meals cooked from the best ingredients various food products and beverages, as well as a breakfast menu. In 2020, the company operated more than 39,000 restaurants. MCD operates three segments:

- The U.S. segment is the company’s largest market. It is 95% franchised.

- International Operated Markets is comprised of markets in which MCD operates and franchises restaurants, including Australia, Canada, France, Germany, Italy, the Netherlands, Russia, Spain and the U.K. The segment is 84% franchised.

- International Developmental Licensed Markets & Corporate is comprised of developmental licensee and affiliate markets in the McDonald’s system. Corporate activities are also reported in this segment. The segment is 98% franchised.

| Segment | 2020 Revenue (USD billions) | Revenue % |

| U.S. | 7.829 | 41% |

| International operated Markets | 9.571 | 50% |

| International Developmental Licensed Markets & Corporate | 1.809 | 9% |

MCD’s revenues are well diversified geographically with 63% of sales coming from outside the U.S.

MCD’s Dividend History and Payout Ratio

MCD has an excellent track record of paying and increasing dividends for 45 consecutive years, a record that the company will feel highly obligated to maintain. This dividend growth track record brings McDonald’s close to becoming a dividend king (a company that has a track record of increasing dividend payouts for more than 50 years), the most prestigious dividend growth category there is.

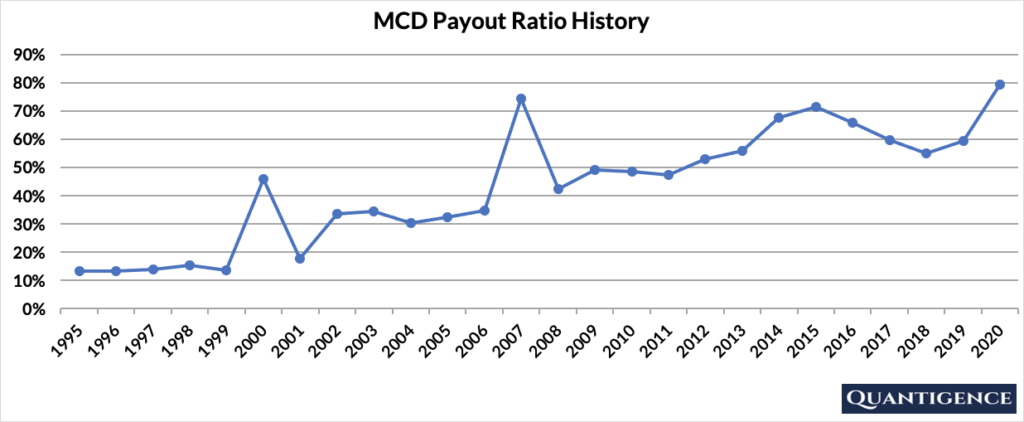

In 2020, MCD paid out 79% of its profits in the form of dividends. This payout ratio isn’t low but still enables the company to keep growing its dividend in the future, even if earnings are not growing or temporarily declining. In looking at the company’s payout ratio history over the past 25 years, it’s been steadily trending upwards.

When Does MCD Pay Dividends?

MCD pays a quarterly dividend typically announced in the second half of January, May, July, and September. The ex-dates are usually around the end of February, May, August, and November, and payments are made in the middle of the following months (March, June, September, and December).

What is MCD’s Dividend Yield?

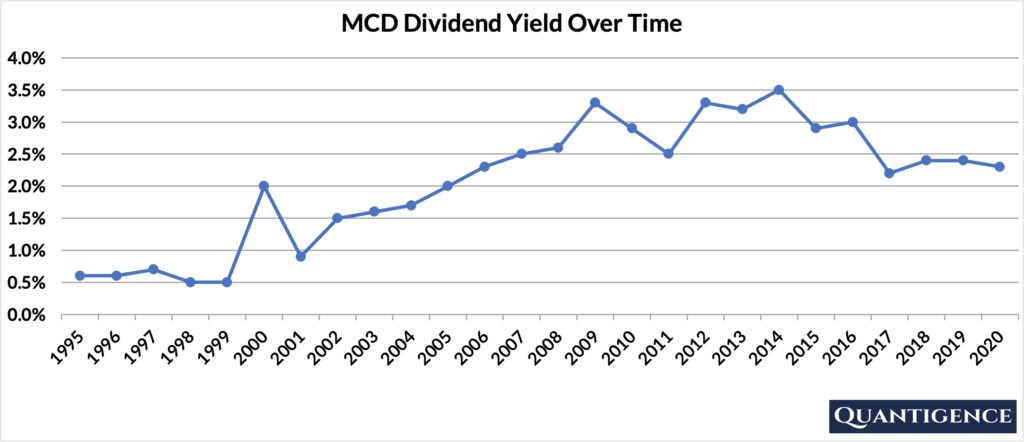

Dividend yield (the annual dividend paid divided by the share price) shows the 1-year return on a stock purchase in the form of dividends. In 2020, MCD had a dividend yield of 2.3%, higher than our investment universe average of 1.8%. The stock’s historical yield has been moving between 0.5% and 3.5% with an average of 2.1%.

MCD’s Dividend Growth Rate

MCD has grown its dividend payout by an average of 8.4% every year for the past 10 years. However, that growth seems to be slowing lately with the annual dividend increase averaging 7.9% over the last five years, a growth rate that well outpaces inflation. Below you can see the effect a 10-year growth rate of 8.4% has on MCD’s dividend assuming a starting yield of 2.3%.

| Years | Dividend Growth | Yield Calculation | Yield % |

| Year 0 | 0% | 2.30% | 3.00% |

| Year 1 | 8.40% | 2.3%*1.084 | 3.19% |

| Year 2 | 8.40% | 2.3%*(1.084)^2 | 3.40% |

| Year 3 | 8.40% | 2.3%*(1.084)^3 | 3.61% |

| Year 4 | 8.40% | 2.3%*(1.084)^4 | 3.84% |

| Year 5 | 8.40% | 2.3%*(1.084)^3 | 4.09% |

| Year 6 | 8.40% | 2.3%*(1.084)^6 | 4.35% |

| Year 7 | 8.40% | 2.3%*(1.084)^7 | 4.63% |

| Year 8 | 8.40% | 2.3%*(1.084)^8 | 4.93% |

| Year 9 | 8.40% | 2.3%*(1.084)^9 | 5.24% |

| Year 10 | 8.40% | 2.3%*(1.084)^10 | 5.58% |

If you bought MCD at a yield of 2.3%, an average 10-year dividend growth of 8.4% would mean your yield would be 5.58% 10 years from now. This is called “yield on cost,” and shows the yield you’re receiving on the original amount of money you invested.

How Strong is MCD’s Dividend?

When evaluating dividend stocks, we use our own methodology which is based on Q-scores which consist of seven factors:

- Years paying and increasing dividends

- Market cap

- International sales

- Yield

- Payout ratio

- Five-year dividend growth rate

- Ten-year dividend growth rate

We calculate each of these factors and summarize them in a final proprietary Q-score. To learn more about how we calculate Q-scores, check out our piece on “7 Factors Used to Select Dividend Growth Stocks.”

The Q-score for McDonald’s Corporation is presently 18.0, the highest in the consumer discretionary sector and ninth-highest in our dividend growth investment universe. We reward MCD for its size, dividend growth track record, and international sales. MCD’s five and 10-year dividend growth rates are also high enough to contribute a significant amount to its overall Q-score. The company’s yield and payout ratio are fine, so they contribute to a lesser extent.

McDonald’s is an excellent dividend growth stock and the top performer in the consumer discretionary sector, a sector that benefits when people have disposable income. We would argue that MCD’s business leans towards consumer staples because, in times of recession, people opt to go for cheap food. This makes MCD a safe bet in times of market downturns and earns the company a place in our final 30-stock dividend growth portfolio.