International Business Machines Corporation (NYSE: IBM) provides integrated IT solutions and services worldwide through five segments:

- Cloud & Cognitive Software offers software for vertical and domain-specific solutions in many application areas, across different industries like banking, airlines, and retail

- Global Business Services offers business consulting services; system integration, application management, maintenance, and support services for packaged software

- Global Technology Services provides IT infrastructure and platform services

- Systems offers servers and data storage solutions for businesses, cloud service providers, and scientific computing organizations

- Global Financing provides lease, installment payment, loan financing, and short-term working capital financing

IBM’s revenues are diversified almost equally across its three main segments as well as geographically (54% of sales comes from outside the U.S.).

| Segment | 2020 Revenue (in billion USD) | Revenue % |

| Cloud & Cognitive Software | 19.107 | 32% |

| Global Business Services | 15.896 | 27% |

| Global Technology Services | 19.632 | 33% |

| Systems | 3.466 | 6% |

| Global Financing | 0.834 | 1% |

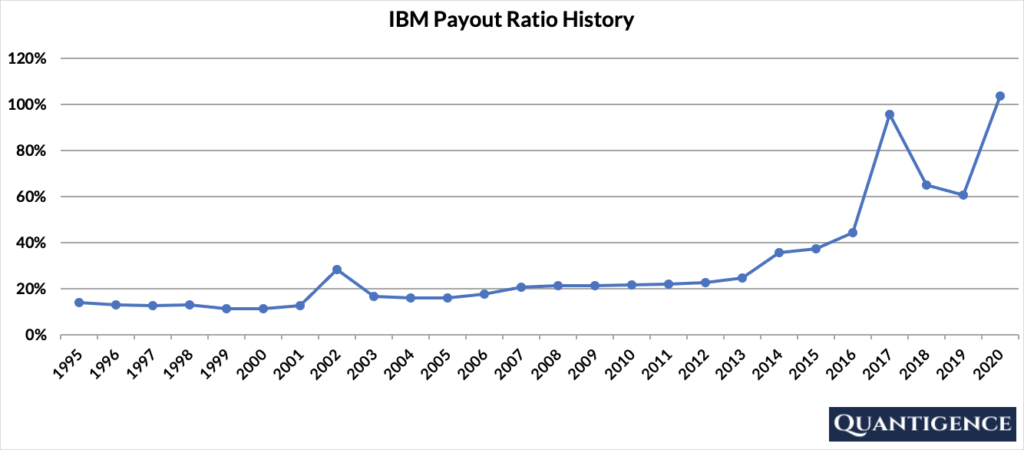

IBM’s Dividend History and Payout Ratio

IBM has a track record of paying and increasing dividends for 25 consecutive years, making it a newcomer to the prestigious club of dividend champions. In 2020, IBM paid out 104% of its profits in the form of dividends. Paying more dividends than earnings is a red flag because it makes future dividend payments potentially unsustainable. In looking at the company’s payout ratio history over the past 25 years, we see a stable low payout ratio that spikes after 2016.

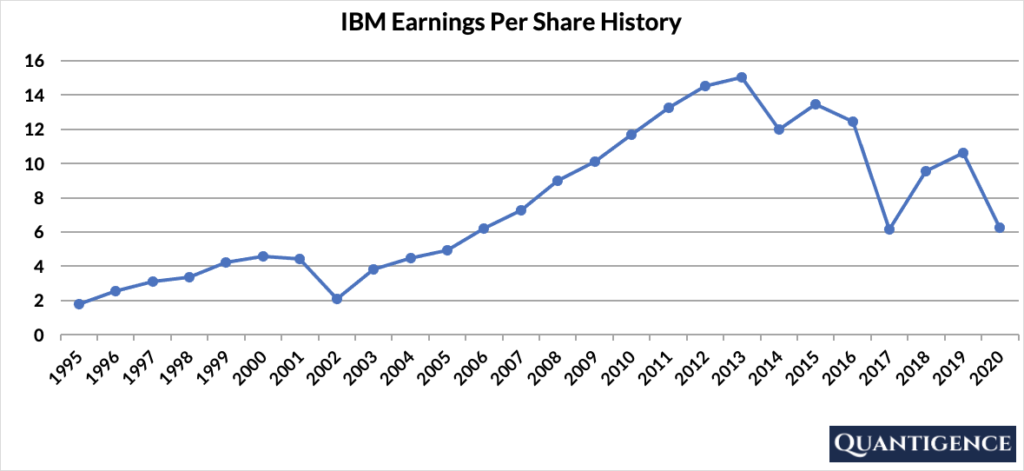

IBM seems to be struggling with growth since 2014. The company’s declining earnings resulted in a sharp increase of its dividend payout ratio and also raised some questions about its overall strategy that revolves around selling each customer “a combination of hardware, software, consulting and the ability to finance it all.”

When Does IBM Pay Dividends?

IBM pays a quarterly dividend typically announced around the end of January, April, July, and October. The ex-dates are around the second week of the following months, and payments are made on the 9th or 10th day of the months after that (March, June, September, and December).

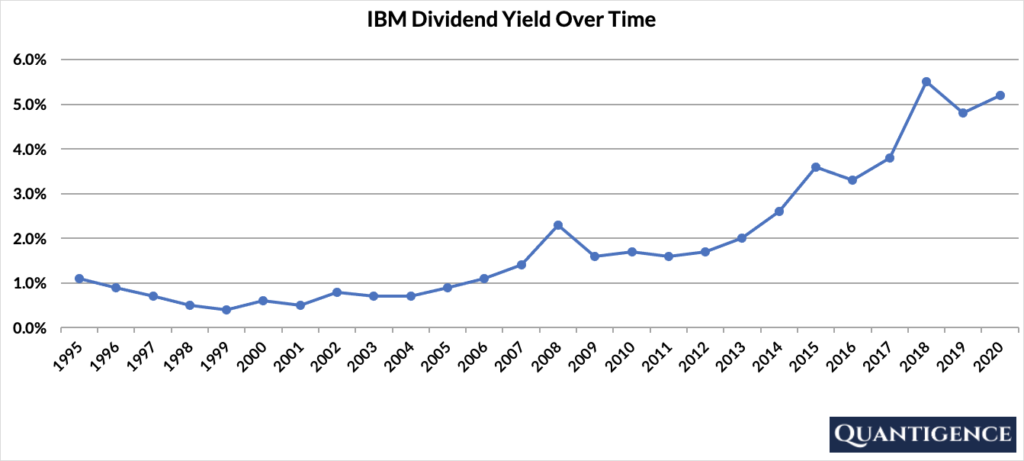

What is IBM’s Dividend Yield?

Dividend yield (the annual dividend paid divided by the share price) shows the 1-year return on a stock purchase in the form of dividends. In 2020, IBM had a dividend yield of 5.2%, almost three times the value of our investment universe average of 1.8%. The stock’s historical yield has been moving between 0.4% and 5.8% with an average of 1.9%. A high yield like IBM’s current one is usually a red flag that shows uncertainty around future dividend increases. This uncertainty is reflected in the stock price that is low relative to IBM’s dividend payments.

IBM’s Dividend Growth Rate

IBM has grown its dividend payout by an average of 10.0% every year for the past 10 years. However, that growth seems to be slowing lately with the annual dividend increase averaging 5.4% over the last five years, a growth number that’s quickly becoming mediocre. Below you can see the effect a 10-year growth rate of 10.0% has on IBM’s dividend assuming a starting yield of 5.2%.

| Years | Dividend Growth | Yield Calculation | Yield % |

| Year 0 | 0% | 5.20% | 5.2% |

| Year 1 | 10.00% | 5.2%*1.1 | 5.72% |

| Year 2 | 10.00% | 5.2%*(1.1)^2 | 6.29% |

| Year 3 | 10.00% | 5.2%*(1.1)^3 | 6.92% |

| Year 4 | 10.00% | 5.2%*(1.1)^4 | 7.61% |

| Year 5 | 10.00% | 5.2%*(1.1)^3 | 8.37% |

| Year 6 | 10.00% | 5.2%*(1.1)^6 | 9.21% |

| Year 7 | 10.00% | 5.2%*(1.1)^7 | 10.13% |

| Year 8 | 10.00% | 5.2%*(1.1)^8 | 11.15% |

| Year 9 | 10.00% | 5.2%*(1.1)^9 | 12.26% |

| Year 10 | 10.00% | 5.2%*(1.1)^10 | 13.49% |

If you bought IBM at a yield of 5.2%, an average 10-year dividend growth of 10.0% would mean your yield would be an impressive 13.49% 10 years from now. This is called “yield on cost,” and shows the yield we’re receiving on the original amount of money we invested.

How Strong is IBM’s Dividend?

When evaluating dividend stocks, we use our own methodology which is based on Q-scores which consist of seven factors:

- Years paying and increasing dividends

- Market cap

- International sales

- Yield

- Payout ratio

- Five-year dividend growth rate

- Ten-year dividend growth rate

We calculate each of these factors and summarize them in a final proprietary Q-score. To learn more about how we calculate Q-scores, check out our piece on “7 Factors Used to Select Dividend Growth Stocks.”

The Q-score for IBM Corporation is presently 15.4, which ranks the company as the 21st by Q-score in our dividend growth investment universe. We reward IBM for its large size, high yield, and 10-year dividend growth rate. Its dividend growth track record and five-year dividend growth rate are mediocre so they contribute less to the company’s overall Q-score. The payout ratio is above 100% and receives a penalty.

There is a lack of dividend champions in the “Information Technology” sector with only three companies available, and IBM is sitting at the top with the highest Q-score in the sector. The company’s struggle to return to growth poses risks to dividend growth investors, but its size and incumbent position in many markets offer some stability. For better or for worse, IBM is one of the 30 stocks we’re holding in our own dividend growth investing portfolio.