Albemarle Corporation (NYSE: ALB) is a global specialty chemicals company with three segments: Lithium, Bromine Specialties, and (refining) Catalysts. The company serves many industries from energy and communications to transportation and electronics. Albemarle employs approximately 5,400 people and serves customers in approximately 100 countries.

ALB’s revenues are well diversified geographically (76% of sales comes from outside the U.S.) and between its three segments.

| Segment | 2020 Revenue (in billion USD) | Revenue % |

| Lithium | 1.145 | 37% |

| Bromine Specialties | 0.965 | 31% |

| Catalysts | 0.798 | 26% |

| All Other | 0.221 | 7% |

ALB’s Dividend History and Payout Ratio

ALB is a relative newcomer to the league of dividend champions with a track record of paying and increasing dividends for 27 consecutive years, a record that the company will likely feel highly obligated to maintain.

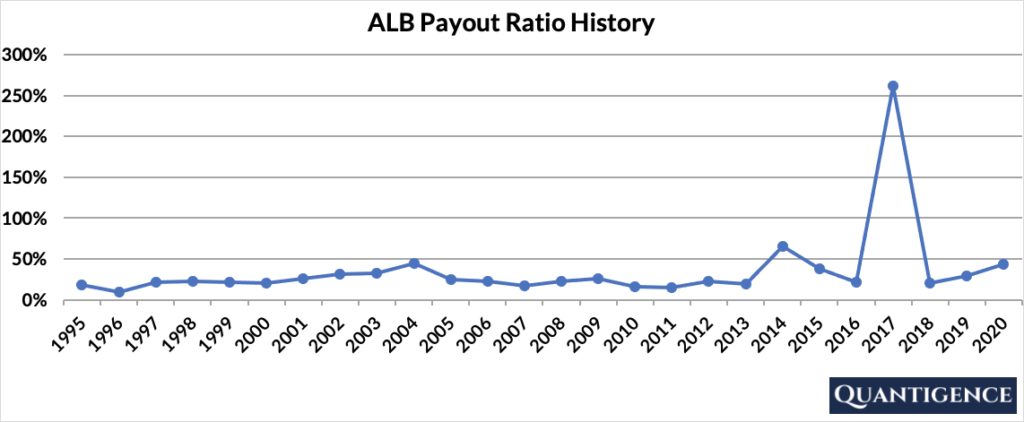

In 2020, ALB paid out only 44% of its profits in the form of dividends. This low payout ratio enables the company to keep growing its dividend in the future, even if earnings are not growing or temporarily declining. In looking at the company’s payout ratio history over the past 20 years, it’s been remarkably stable. The only spike seen in 2017 happened because of a tax law change where ALB booked a one-time transition tax expense of $429.2 million that reduced its earnings by 97%.

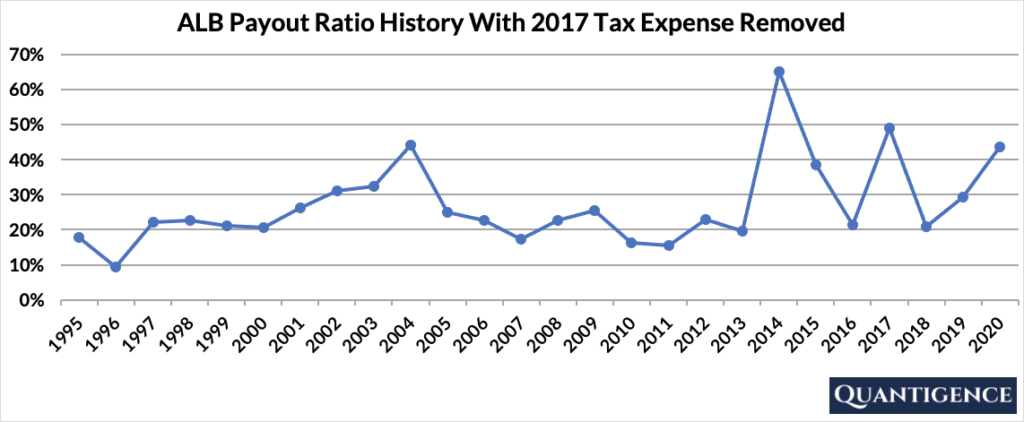

If we correct Albemarle’s earnings to remove the tax expense in 2017, we see a much smoother payout ratio.

When Does ALB Pay Dividends?

ALB pays a quarterly dividend typically announced in February, May, July, and October. The ex-dates are around the middle of March, June, September, and December and payments are made in the first days of the following months (April, July, October, and January).

What is ALB’s Dividend Yield?

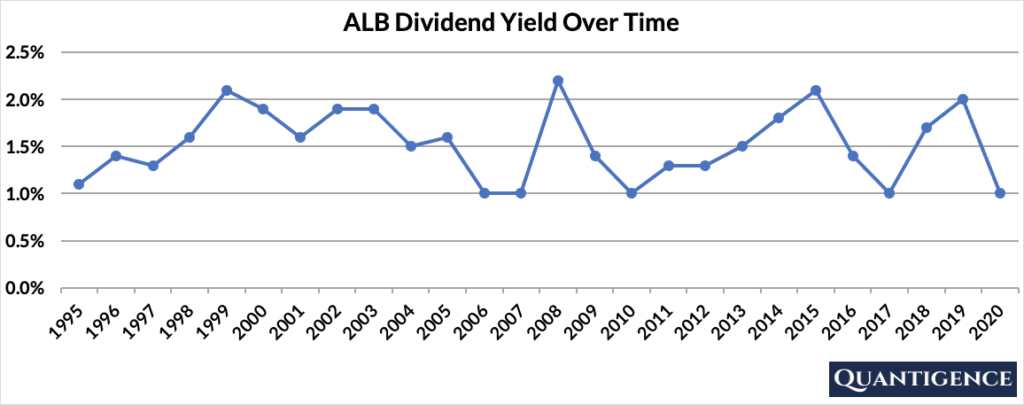

Dividend yield (the annual dividend paid divided by the share price) shows the 1-year return on a stock purchase in the form of dividends. In 2020, ALB had a dividend yield of 1.0%, below our investment universe average of 1.8%. The stock’s historical yield over the past 25 years has been moving between 1.0% and 2.2% with an average of 1.5%.

ALB’s Dividend Growth Rate

ALB has grown its dividend payout by an average of 10.6% every year for the past 10 years. However, that growth seems to be slowing lately with the annual dividend increase averaging 5.8% over the last five years. Below you can see the effect a 10-year growth rate of 10.6% has on ALB’s dividend assuming a starting yield of 1.0%.

| Years | Dividend Growth | Yield Calculation | Yield % |

| Year 0 | 0% | 1.00% | 1.0% |

| Year 1 | 10.60% | 1.0%*1.106 | 1.11% |

| Year 2 | 10.60% | 1.0%*(1.106)^2 | 1.22% |

| Year 3 | 10.60% | 1.0%*(1.106)^3 | 1.35% |

| Year 4 | 10.60% | 1.0%*(1.106)^4 | 1.50% |

| Year 5 | 10.60% | 1.0%*(1.106)^3 | 1.65% |

| Year 6 | 10.60% | 1.0%*(1.106)^6 | 1.83% |

| Year 7 | 10.60% | 1.0%*(1.106)^7 | 2.02% |

| Year 8 | 10.60% | 1.0%*(1.106)^8 | 2.24% |

| Year 9 | 10.60% | 1.0%*(1.106)^9 | 2.48% |

| Year 10 | 10.60% | 1.0%*(1.106)^10 | 2.74% |

If you bought ALB at a yield of 1.0%, an average 10-year dividend growth of 10.6% would mean your yield would be a meagre 2.74% 10 years from now. This is called “yield on cost,” and shows the yield we’re receiving on the original amount of money we invested.

How Strong is ALB’s Dividend?

When evaluating dividend stocks, we use our own methodology which is based on Q-scores which consist of seven factors:

- Years paying and increasing dividends

- Market cap

- International sales

- Yield

- Payout ratio

- Five-year dividend growth rate

- Ten-year dividend growth rate

We calculate each of these factors and summarize them in a final proprietary Q-score. To learn more about how we calculate Q-scores, check out our piece on “7 Factors Used to Select Dividend Growth Stocks.”

The Q-score for Albemarle Corporation is presently 13.8, below our dividend growth portfolio average of 14.6. ALB’s international sales, 10-year dividend growth rate, and payout ratio are excellent, so these factors are rewarded. Market cap, dividend growth track record, and five-year dividend growth rate are mediocre, so these contribute less to the overall Q-score. ALB’s yield is very low so we penalize that.

Albemarle is the third company by overall Q-score out of seven dividend champions in the Materials sector. With two better alternatives to choose from in a relatively small sector, Albemarle isn’t in our 30-stock dividend growth portfolio.

[optin-monster slug=”ziwrnabndtepsyq0fyai”]