Colgate-Palmolive (NYSE: CL) manufactures and sells fast-moving consumer goods worldwide through its four segments: Oral Care, Personal Care, Home Care, and Pet Nutrition. The company’s products include oral hygiene products, soaps, shower gels, hair care, deodorants, skin products, detergents, fabric conditioners, household cleaners, other similar items, and pet nutrition products.

Around 70% of sales come from international markets. Across segments 2020 revenue can be broken down as follows:

| Segment | 2020 Sales % |

| Oral Care | 44% |

| Personal Care | 21% |

| Home Care | 18% |

| Pet Nutrition | 17% |

CL’s Dividend History and Payout Ratio

CL has an excellent track record of paying and increasing dividends for 57 consecutive years, a record that the company will likely feel highly obligated to maintain. This dividend growth track record makes CL a dividend king (a company that has a track record of increasing dividend payouts for more than 50 years), the most prestigious dividend growth category there is.

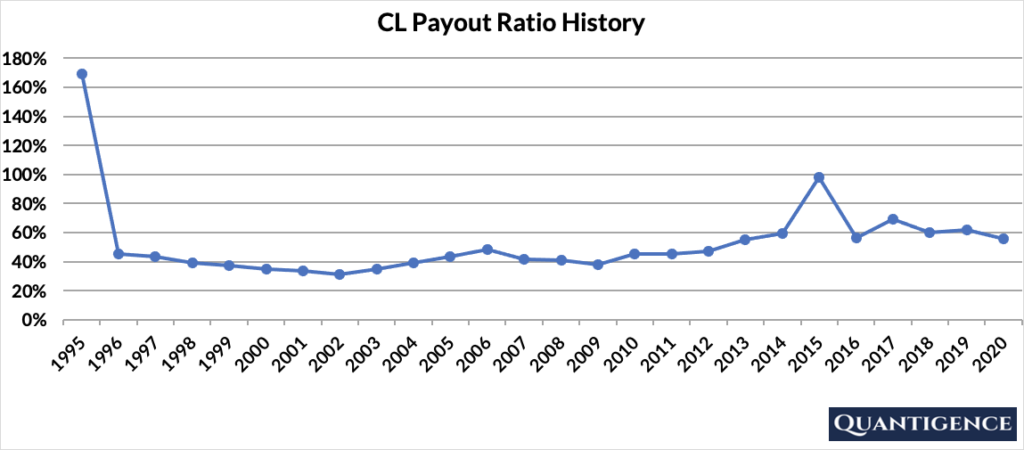

In 2020, CL paid out 56% of its profits in the form of dividends. The company’s payout ratio has been steady for the past 25 years with an average of 53%. The two notable exceptions were in 1995 when CL booked restructuring costs that amounted to 56% of its earnings, and in 2015 when it applied an accounting change in Venezuela that decreased its earnings by 44%. Both of these were one-time non-cash items on CL’s books that do not affect the company’s long-term performance.

When Does CL Pay Dividends?

CL pays a quarterly dividend announced in January, March, June, and September. The ex-dates are usually in the second half of January, April, July, and October. Payments are made in the middle of February, May, August, and November.

What is CL’s Dividend Yield?

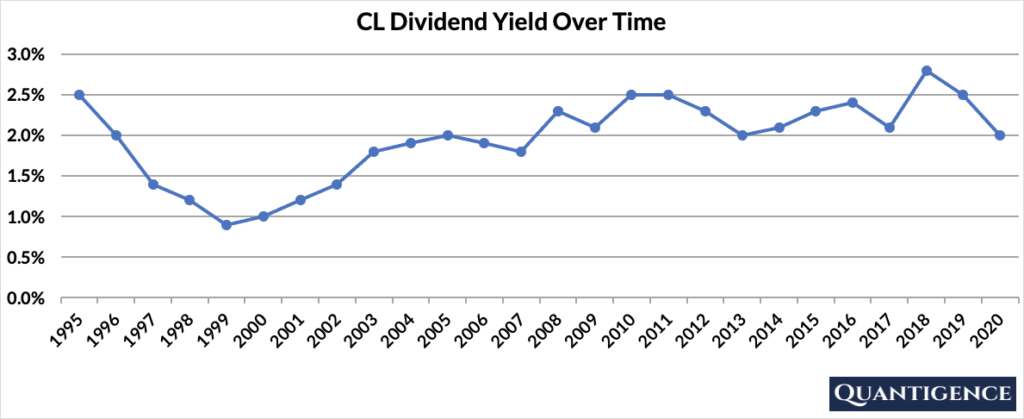

Dividend yield (the yearly dividend paid divided by the share price) shows the 1-year return on a stock purchase in the form of dividends. In 2020, CL had a dividend yield of 2.0%. This value is slightly above the 1.8% average of our investment universe of US dividend champions. The stock’s yield has been stable over the past 15 years averaging 2.2%.

CL’s Dividend Growth Rate

CL has increased its dividend payout by an average of 5.6% every year for the past 10 years. However, dividend increases have slowed to an annual 3.1% average over the past five years. Below, you can see the effect a 10-year growth rate of 5.6% has on CL’s dividend assuming a starting yield of 2.0%.

| Years | Dividend Growth | Yield Calculation | Yield % |

| Year 0 | 0% | 2.00% | 2.0% |

| Year 1 | 5.60% | 2.0%*1.056 | 2.11% |

| Year 2 | 5.60% | 2.0%*(1.056)^2 | 2.23% |

| Year 3 | 5.60% | 2.0%*(1.056)^3 | 2.36% |

| Year 4 | 5.60% | 2.0%*(1.056)^4 | 2.49% |

| Year 5 | 5.60% | 2.0%*(1.056)^5 | 2.63% |

| Year 6 | 5.60% | 2.0%*(1.056)^6 | 2.77% |

| Year 7 | 5.60% | 2.0%*(1.056)^7 | 2.93% |

| Year 8 | 5.60% | 2.0%*(1.056)^8 | 3.09% |

| Year 9 | 5.60% | 2.0%*(1.056)^9 | 3.27% |

| Year 10 | 5.60% | 2.0%*(1.056)^10 | 3.45% |

If you bought CL at a yield of 2.0%, an average 10-year dividend growth of 5.6% would mean our yield would be 3.45% 10 years from now. This is called “yield on cost,” and shows the yield if the original amount of money invested in the stock remained constant.

How Strong is CL’s Dividend?

When evaluating dividend stocks, we use our own methodology which is based on Q-scores which consist of seven factors:

- Years paying and increasing dividends

- Market cap

- International sales

- Yield

- Payout ratio

- Five-year dividend growth rate

- Ten-year dividend growth rate

We calculate each of these factors and summarize them in a final proprietary Q-score. To learn more about how we calculate Q-scores, check out our piece on “7 Factors Used to Select Dividend Growth Stocks.”

The Q-score for Colgate-Palmolive is presently 15.4, slightly higher than our dividend growth portfolio average of 14.6. CL’s dividend growth track record, international sales ratio, and payout ratio are excellent, so these are rewarded. Market cap, yield and 10-year dividend growth are fine but not outstanding, so these contribute to a lesser extent. CL’s five-year dividend growth is low and we penalize them for that.

CL is a great dividend growth stock taking fifth position in the Consumer Staples sector. As we’re already holding PG, another fast-moving consumer goods company in the sector, we do not include CL in our portfolio.

[optin-monster slug=”ziwrnabndtepsyq0fyai”]