ExxonMobil (NYSE: XOM) is one of the world’s largest publicly traded energy providers and chemical manufacturers. The company operates in three reporting segments: Upstream, Downstream, and Chemical.

The Upstream segment produces about 4 million oil-equivalent barrels of net oil and natural gas per day. The Downstream segment manufactures and markets fuels and lubricants, and sells about 5 million barrels of petroleum products per day. XOM’s Chemical segment produces basic chemicals used as building blocks for many of the products essential to modern life and its performance products are used in a wide range of consumer applications, including food packaging, vehicles, and diapers.

| Segment | 2020 Revenue (in billion USD) | Revenue % |

| Upstream | 14.5 | 8% |

| Downstream | 140.9 | 79% |

| Chemical | 23.1 | 13% |

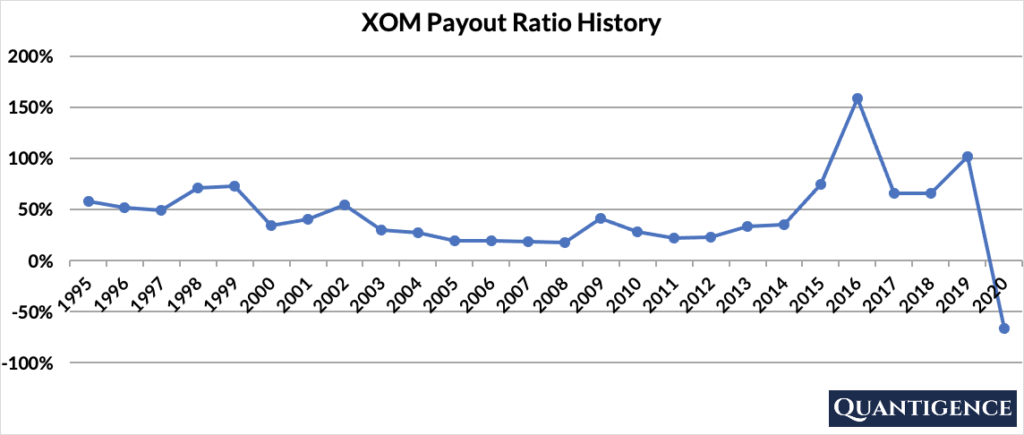

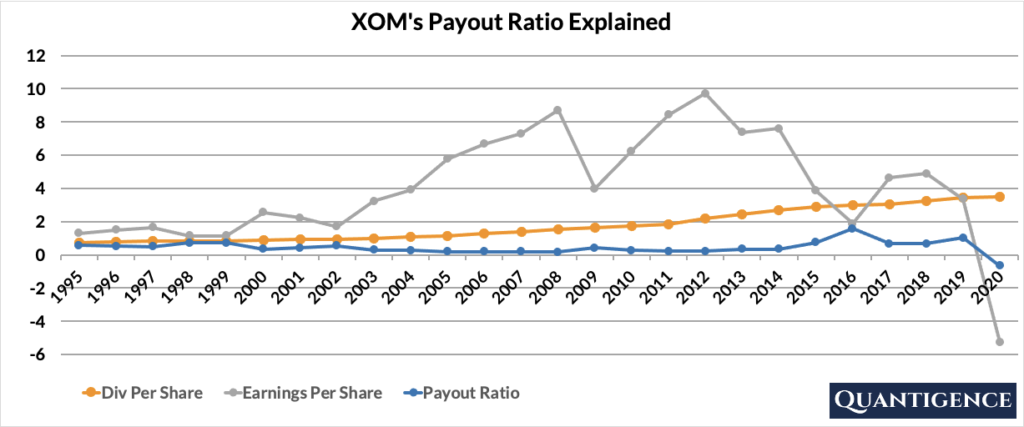

XOM’s Dividend History and Payout Ratio

XOM has been paying and increasing their dividend for 38 years. Up until 2015, the company had a stable payout ratio below 50% for more than a decade.

From 2015 onwards, XOM’s earnings per share started to decline and they remain volatile to this day. Paying increasing dividends from declining earnings is not sustainable over the long term, but the shaky situation was further exacerbated by the COVID-19 pandemic. In 2020, Exxon Mobil’s earnings reached negative territory . The losses were offset by adjustments to depreciation provisions and taking on additional debt.

Exxon Mobil’s COVID-19 Problem

Here’s a quote from XOM’s latest annual report which summarizes how exposed the company is to current market dynamics:

Demand reduction due to the COVID-19 pandemic as well as accompanying conditions of oversupply have led to a significant decrease in commodity prices and margins. Future business results… will be affected by the extent and duration of these conditions and the effectiveness of responsive actions that the Corporation and others take, including actions to reduce capital and operating expenses. Market conditions continued to reflect considerable uncertainty throughout 2020.

Exxon Mobil’s 2020 Annual Report

XOM cannot control how COVID-19 will develop, nor can it influence global petroleum output, so the company’s only means to control the situation is to adjust its cost structure. Revenues decreased by 31% while costs decreased by 14% over 2020.

| 2019 | 2020 | Change | |

| Total revenues | 264 938 | 181 502 | -31% |

| Total costs | 244 882 | 210 385 | -14% |

| Net income/loss | 20 056 | – 28 883 | -244% |

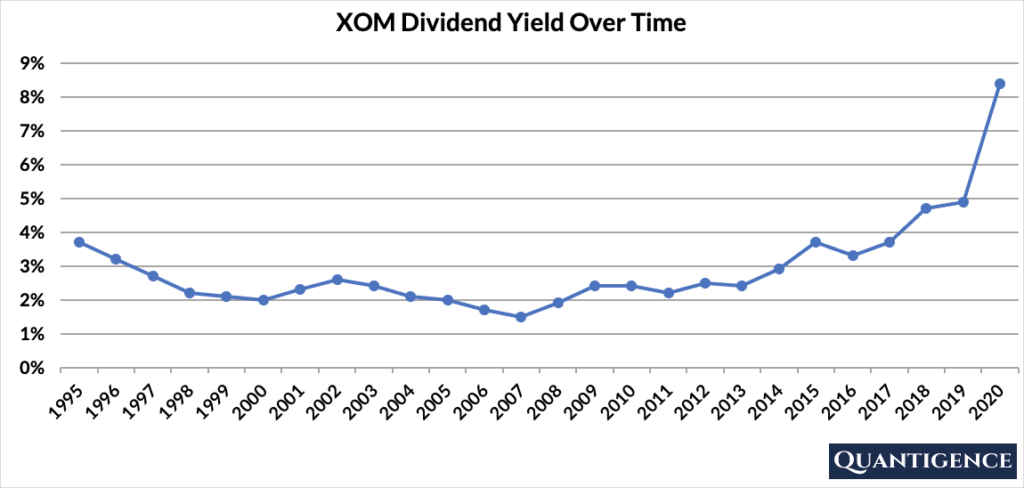

XOM’s Dividend Yield

Dividend yield shows the 1-year return on a stock purchase by dividing annual dividends with the stock price. As of the end of 2020, Exxon Mobil had a dividend yield of 8.4%, an extremely high value. A high dividend yield is a good thing at first glance, but having a yield this high tells us two things.

First, XOM shares are cheap compared to its dividend payments because the risks we mentioned above are reflected in the share price. Second, it shows us how unsustainable XOM dividends are over the long term given the firm’s current situation. To paraphrase one of the pundits, it’s great to see companies pay hefty dividends but it’s even more important to make sure that laying golden eggs isn’t going to kill the golden goose.

XOM’s Dividend Growth Rate

Exxon Mobil has increased its dividend payout by an average of 7.2% every year for the past 10 years. However, that number seems to be decreasing lately with the annual dividend increase averaging 5.4% over the last five years. Below you can see the effect a 10-year growth rate of 7.2% has on XOM’s dividend assuming a starting yield of 8.4%.

| Years | Dividend growth | Yield Calculation | Yield % |

| Year 0 | 0% | 8.4% | 8.4% |

| Year 1 | 7.20% | 8.4%*1.072 | 9.00% |

| Year 2 | 7.20% | 8.4%*(1.072)^2 | 9.65% |

| Year 3 | 7.20% | 8.4%*(1.072)^3 | 10.35% |

| Year 4 | 7.20% | 8.4%*(1.072)^4 | 11.09% |

| Year 5 | 7.20% | 8.4%*(1.072)^5 | 11.89% |

| Year 6 | 7.20% | 8.4%*(1.072)^6 | 12.75% |

| Year 7 | 7.20% | 8.4%*(1.072)^7 | 13.67% |

| Year 8 | 7.20% | 8.4%*(1.072)^8 | 14.65% |

| Year 9 | 7.20% | 8.4%*(1.072)^9 | 15.70% |

| Year 10 | 7.20% | 8.4%*(1.072)^10 | 16.84% |

If you bought XOM at a yield of 8.4%, an average 10-year dividend growth of 7.2% would mean our yield would be 16.8% 10 years from now. An extremely high yield which shows how unsustainable Exxon Mobil’s current predicament is. This is called “yield on cost,” and shows the yield if the original amount of money invested in the stock remained constant.

When Does XOM Pay Dividends?

XOM pays quarterly dividends that are announced at the end of January, April, July, and October. The ex-dates (the date you need to hold the stock to receive the dividend) follow the announcement date by two weeks and payments are made one month after the ex-date.

How Strong is XOM’s Dividend?

When evaluating dividend stocks, we use our own methodology which is based on Q-scores which consist of seven factors:

- Years paying and increasing dividends

- Market cap

- International sales

- Yield

- Payout ratio

- Five-year dividend growth rate

- Ten-year dividend growth rate

We calculate each of these factors and summarize them in a final proprietary Q-score. To learn more about how we calculate Q-scores, check out our piece on “7 Factors Used to Select Dividend Growth Stocks.”

The Q-score for Exxon Mobil is presently 19, the fifth best score in our investment universe of dividend growth stocks, and fourth best score in our 30-stock portfolio. You might ask how this is possible given the red flags explained in this article.

When we calculate a company’s overall Q-score we use a set of rules that measure dividend stability over the long term. In the case of XOM, the pronounced effects of the COVID-19 pandemic are recent and most likely temporary. We penalize the company for its losses reflected in the high payout ratio and its low five-year growth. We reward it for its size (being the 7th biggest company in our investment universe), for its diversified business (65% of sales comes from international markets) and its high yield (unsustainable as it may be, XOM’s high yield is a fact).

Exxon Mobil might be in a risky position now but it has the size and track record that gives it stability. As one of the three energy companies in our dividend champion investment universe, we are holding XOM shares in our Quantigence portfolio and hope the company can manage its current crisis.