We don’t play favorites when building our dividend growth portfolio because the process is almost entirely rules-based. But if we had to select a teacher’s pet, it would be NextEra Energy (NYSE: NEE), the world’s largest utility company. It is also the world’s largest generator of renewable energy from the wind and sun, and a world leader in battery storage. NEE is the only stock we’re holding in our dividend growth portfolio and our disruptive technology portfolio over at Nanalyze.

NEE’s subsidiaries include Florida Power & Light Company (FPL), which is the largest rate-regulated electric utility in the United States as measured by retail electricity produced and sold. FPL serves more than 5.6 million customer accounts, supporting more than 11 million residents across Florida with electricity. NextEra Energy also owns NextEra Energy Resources LLC, which, together with its affiliated entities, is the world’s largest generator of renewable energy from the wind and sun and a world leader in battery storage. Through its subsidiaries, NEE generates clean, emissions-free electricity from seven commercial nuclear power units in Florida, New Hampshire and Wisconsin.

NEE’s Dividend History and Payout Ratio

NEE is a relative newcomer to the prestigious club of dividend champions (companies that have been paying increasing their dividends for at least 25 years) having started its continuous dividend increases 27 years ago.

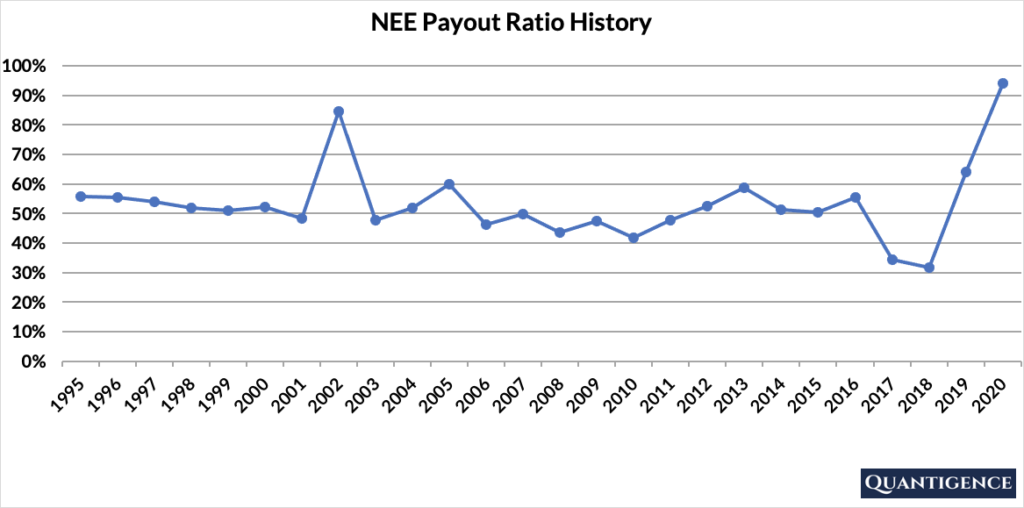

The company’s payout ratio is 94% which means NEE pays out almost all of its profits to shareholders in the form of a dividend. Here’s how the company’s payout ratio has changed over time:

The first thing to notice is how volatile the payout ratio is. Usually, large dividend paying companies have stable consistent growth. This means the payout ratio simply increases gradually over time as dividend payments increase. This is not the case with NEE though.

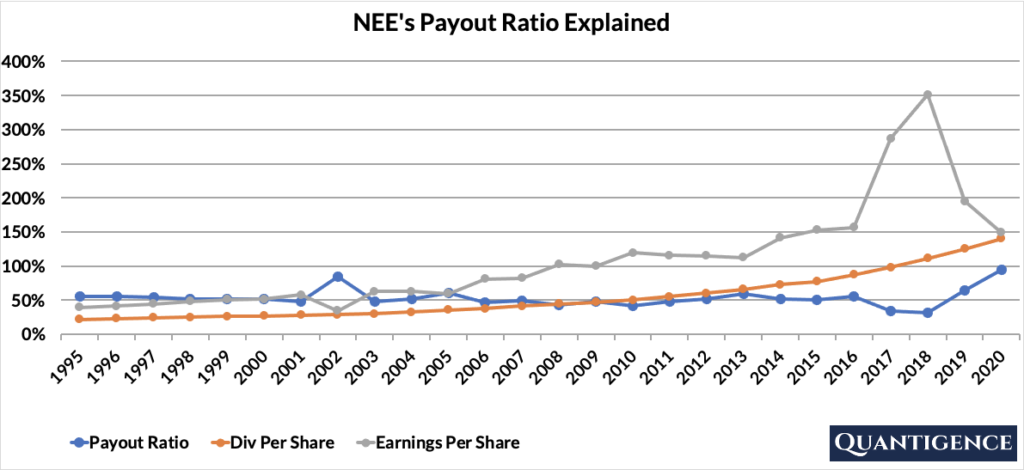

To calculate the payout ratio, we divide the dividend per share (DPS) with the earnings per share (EPS). As long as the DPS is less than the EPS, the payout ratio remains below 100%. When it becomes more than 100%, the company starts to pay more dividends than the amount of money it actually earns throughout the year, a situation that’s unsustainable over the long term.

If we plot the DPS and EPS alongside the payout ratio, we see the dividends increase incrementally, but the earnings fluctuate. NEE has a significant earnings drop in 2020 compared to previous years. A large part of this ($1.2 billion) is attributed to impairment charges on its Mountain Valley gas pipeline, one of the several oil and gas pipelines delayed in recent years by regulatory and legal fights with states and environmental groups that found problems with permits issued by the previous administration.

This means NEE earnings in 2020 were hit by a one-time event and should climb back up in 2021, pushing the payout ratio down. That’s the good news. The bad news is the payout ratio is close to 100% so NextEra had no profits to reinvest in 2020.

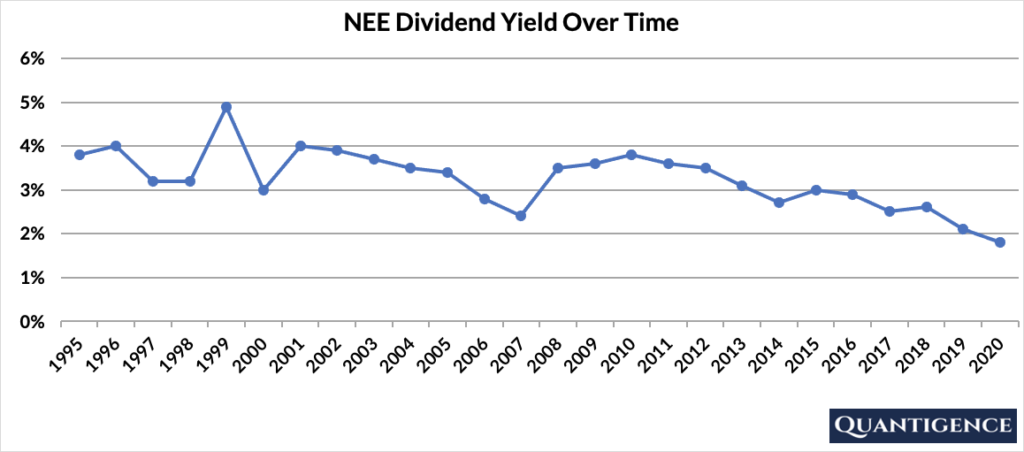

NEE’s Dividend Yield

The dividend yield is the dividend per share over the course of a year divided by the stock price. Simply put, it shows the 1-year return on a stock purchase in the form of dividends. As of the end of 2020, NextEra had a dividend yield of 1.8%, a historic low. This shows NEE shares are currently priced relatively high compared to its dividend payments. The stock’s yield history shows a downward trend over the past 25 years.

NEE’s Dividend Growth Rate

On the flipside, NextEra has been increasing its dividends aggressively for a long time. The average dividend increase over the past 10 years was 10.8% per year, and over the past five years it’s been 12.7%. Below you can see the effect a 10-year growth rate of 10.8% has on NEE’s dividend assuming a starting yield of 1.8%.

| Years | Dividend growth | Yield Calculation | Yield % |

| Year 0 | 0% | 1.8% | 1.8% |

| Year 1 | 10.80% | 1.8%*1.108 | 1.99% |

| Year 2 | 10.80% | 1.8%*(1.108)^2 | 2.21% |

| Year 3 | 10.80% | 1.8%*(1.108)^3 | 2.45% |

| Year 4 | 10.80% | 1.8%*(1.108)^4 | 2.71% |

| Year 5 | 10.80% | 1.8%*(1.108)^5 | 3.01% |

| Year 6 | 10.80% | 1.8%*(1.108)^6 | 3.33% |

| Year 7 | 10.80% | 1.8%*(1.108)^7 | 3.69% |

| Year 8 | 10.80% | 1.8%*(1.108)^8 | 4.09% |

| Year 9 | 10.80% | 1.8%*(1.108)^9 | 4.53% |

| Year 10 | 10.80% | 1.8%*(1.108)^10 | 5.02% |

If you bought NEE at a yield of 1.8%, an average 10-year dividend growth of 10.8% would mean our yield would be 5.02% 10 years from now. This is called “yield on cost,” and shows the yield if the original amount of money invested in the stock remained constant

When Does NEE Pay Dividends?

NEE pays quarterly dividends that are announced in February, May, July, and October. The ex-dates (the date you need to hold the stock to receive the dividend) tend to follow the announcement date by 1-4 weeks and payments are made 4-8 weeks after the ex-date.

How Strong is NEE’s Dividend?

When evaluating dividend stocks, we use our own methodology which is based on Q-scores which consist of seven factors:

- Years paying and increasing dividends

- Market cap

- International sales

- Yield

- Payout ratio

- Five-year dividend growth rate

- Ten-year dividend growth rate

We calculate each of these factors and summarize them in a final proprietary Q-score. To learn more about how we calculate Q-scores, check out our piece on “7 Factors Used to Select Dividend Growth Stocks.”

The Q-score for NextEra Energy is presently 10.8, below the portfolio average of 14.6 and the investment universe average of 13.1. NEE is the 25th holding in the final Quantigence portfolio by overall Q-score.

We penalize the company for its high payout ratio. We reward it for its size (being the 9th biggest company in our portfolio) and for its high dividend growth rate. As a utilities company that doesn’t have international sales, we count that particular factor as zero. NEE’s yield is mediocre, so that part of the Q-score gets a low value.

NextEra Energy might not be the sexiest dividend growth stock out there but its global leading position in wind and solar energy, its aggressive dividend increases, and large size make it a desirable stock for dividend growth investing. When you consider that most dividend companies grow dividends extremely slowly, Next Era Energy is a diamond in the rough.

[optin-monster slug=”ziwrnabndtepsyq0fyai”]