The Coca-Cola Company (NYSE: KO) manufactures, markets, and sells various nonalcoholic beverages worldwide. The company provides sparkling soft drinks, water, enhanced water, sports drinks, juice, dairy, plant-based beverages, tea and coffee, and energy drinks. It also offers beverage concentrates and syrups, as well as fountain syrups to restaurants and convenience stores.

The company breaks down its revenues into a mix of key geographies and other corporate segments. KO’s revenues are driven by North America with the rest nearly equally diversified across other geographies. In 2020, KO’s sales from outside the U.S. amounted to 68%.

| Segment | Revenue % |

| North America | 34.7% |

| Bottling Investments | 19.0% |

| Europe, Middle East & Africa | 16.8% |

| Asia Pacific | 12.8% |

| Latin America | 10.6% |

| Global Ventures | 6.0% |

| Corporate | 0.1% |

Coca-Cola’s Dividend History and Dividend Payout Ratio

KO has an excellent track record of paying and increasing dividends for 59 consecutive years, a record that the company will feel highly obligated to maintain. This dividend growth track record makes KO a dividend king (a company that has a track record of increasing dividend payouts for more than 50 years), the most prestigious dividend growth category there is.

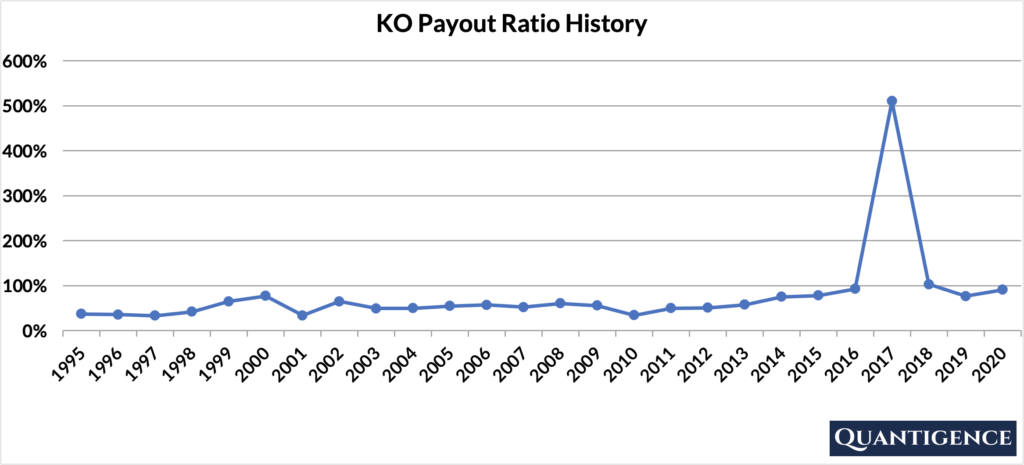

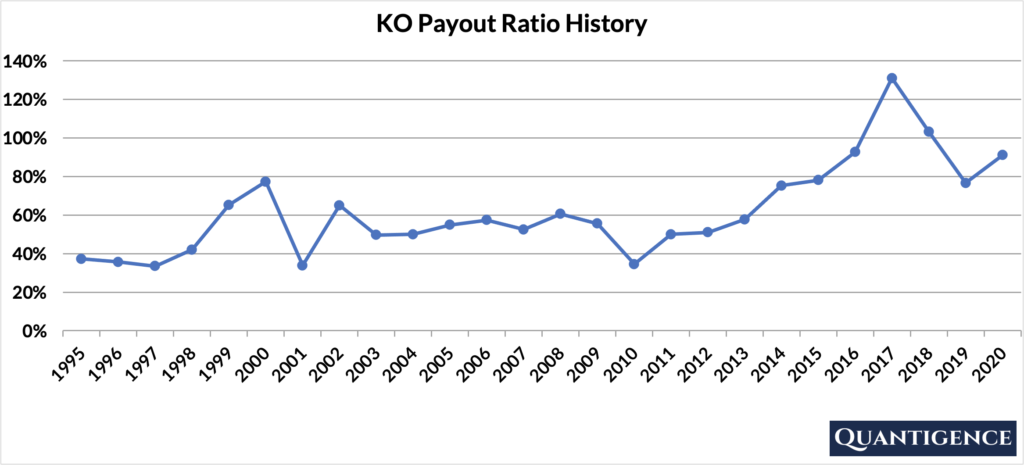

In 2020, KO paid out 91% of its profits in the form of dividends, a fairly high number with little buffer remaining for dividend increases should profits cease growing. Looking at the company’s payout ratio history over the past 25 years shows us a steady increase, from 37% 25 years ago to 91% today.

We see a big spike in the payout ratio at the end of 2017 that can be attributed to new U.S. tax legislation enacted that year that included a comprehensive overhaul of the corporate income tax code. The new law decreased corporate income tax, but also eliminated some tax deductions and introduced new provisions taxing foreign income not previously taxed by the U.S.

The new legislation forced KO to create provisions for these new tax items from its annual earnings, raising KO’s effective tax rate for the year to 82% and eliminating $3.8 billion of its earnings. As KO’s earnings decreased, so did its earnings per share. When Coca-Cola continued to pay an increasing dividend from a fraction of its earnings, the payout ratio jumped to more than 500%.

If we correct this earnings drop attributable to one-off regulatory changes, we see a smoother payout ratio history. Notwithstanding, there are still two years of dividend payouts that are higher than the earnings for the year, in 2017 and 2018.

When Does Coca-Cola Pay Dividends?

KO pays a quarterly dividend typically announced in the second half of February, April, July, and October. The ex-dates are on various dates in March, June, September, and November, and payments are made in the following months (April, July, October, and December).

What is Coca-Cola’s Dividend Yield?

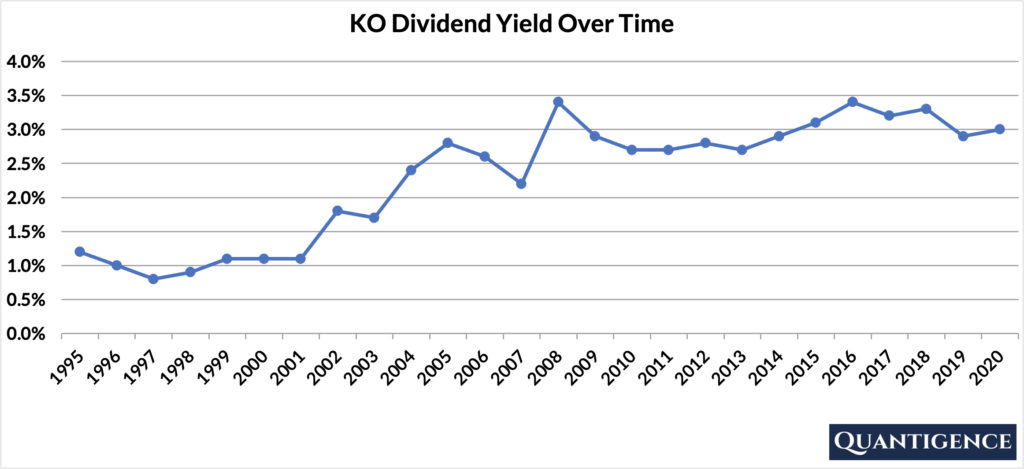

Dividend yield (the annual dividend paid divided by the share price) shows the 1-year return on a stock purchase in the form of dividends. In 2020, KO had a dividend yield of 3.0%, close to double the value of our investment universe average of 1.8%. The stock’s historical yield has been moving between 0.8% and 3.4% with an average of 2.3%.

Coca-Cola’s Dividend Growth Rate

KO has grown its dividend by an average of 6.4% every year for the past 10 years. However, that growth seems to be slowing lately with the annual dividend increase averaging 4.4% over the last five years. Below you can see the effect a 10-year growth rate of 6.4% has on KO’s dividend assuming a starting yield of 3.0%.

| Years | Dividend Growth | Yield Calculation | Yield % |

| Year 0 | 0% | 3.00% | 3.0% |

| Year 1 | 6.40% | 3.0%*1.064 | 3.19% |

| Year 2 | 6.40% | 3.0%*(1.064)^2 | 3.40% |

| Year 3 | 6.40% | 3.0%*(1.064)^3 | 3.61% |

| Year 4 | 6.40% | 3.0%*(1.064)^4 | 3.84% |

| Year 5 | 6.40% | 3.0%*(1.064)^3 | 4.09% |

| Year 6 | 6.40% | 3.0%*(1.064)^6 | 4.35% |

| Year 7 | 6.40% | 3.0%*(1.064)^7 | 4.63% |

| Year 8 | 6.40% | 3.0%*(1.064)^8 | 4.93% |

| Year 9 | 6.40% | 3.0%*(1.064)^9 | 5.24% |

| Year 10 | 6.40% | 3.0%*(1.064)^10 | 5.58% |

If you bought KO at a yield of 3.0%, an average 10-year dividend growth of 6.4% would mean your yield would be 5.58% 10 years from now. This is called “yield on cost,” and shows the yield you’re receiving on the original amount of money you invested.

How Strong is Coca-Cola’s Dividend?

When evaluating dividend stocks, we use our own methodology which is based on Q-scores which consist of seven factors:

- Years paying and increasing dividends

- Market cap

- International sales

- Yield

- Payout ratio

- Five-year dividend growth rate

- Ten-year dividend growth rate

We calculate each of these factors and summarize them in a final proprietary Q-score. To learn more about how we calculate Q-scores, check out our piece on “7 Factors Used to Select Dividend Growth Stocks.”

The Q-score for The Coca-Cola Company is presently 16.6, the fourth-highest Q-score in the “Consumer Staples” sector and 16th best Q-Score in our dividend growth investment universe of 72 stocks.

We reward KO for its size, dividend growth track record, international sales, and yield. We penalize the stock for its low five-year dividend growth rate and high payout ratio. KO’s 10-year dividend growth rate is mediocre, so it contributes little to the stock’s overall Q-score.

Coca-Cola is a solid consumer staples stock with a high payout ratio they need to deal with. When looking at the sector, we had to pick between Pepsi and Coca-Cola as they are similar businesses. We chose KO to include in our portfolio.

[optin-monster slug=”ziwrnabndtepsyq0fyai”]