Sysco Corporation (NYSE: SYY) engages in the marketing and distribution of various food and related products primarily to the foodservice or food-away-from-home industry. It operates four segments:

- U.S. Foodservice Operations distributes a full line of food products, including custom-cut meat, seafood, specialty produce, specialty imports and a wide variety of non-food products

- International Foodservice Operations includes operations in the Americas and Europe, which distribute a full line of food products and a wide variety of non-food products. The Americas primarily consists of operations in Canada, Bahamas, Mexico, Costa Rica, Panama, and other countries. European operations primarily consist of operations in the U.K., France, Ireland and Sweden

- SYGMA is SYY’s U.S. customized distribution subsidiary

- The Other segment primarily covers SYY’s hotel supply operations

| Segment | 2020 Revenue (in billion USD) | Revenue % |

| U.S. Foodservice Operations | 36.774 | 70% |

| International Foodservice Operations | 9.672 | 18% |

| Sygma | 5.556 | 11% |

| Other | 0.891 | 2% |

SYY’s revenues are concentrated in the U.S. with about 21% of sales coming outside the United States.

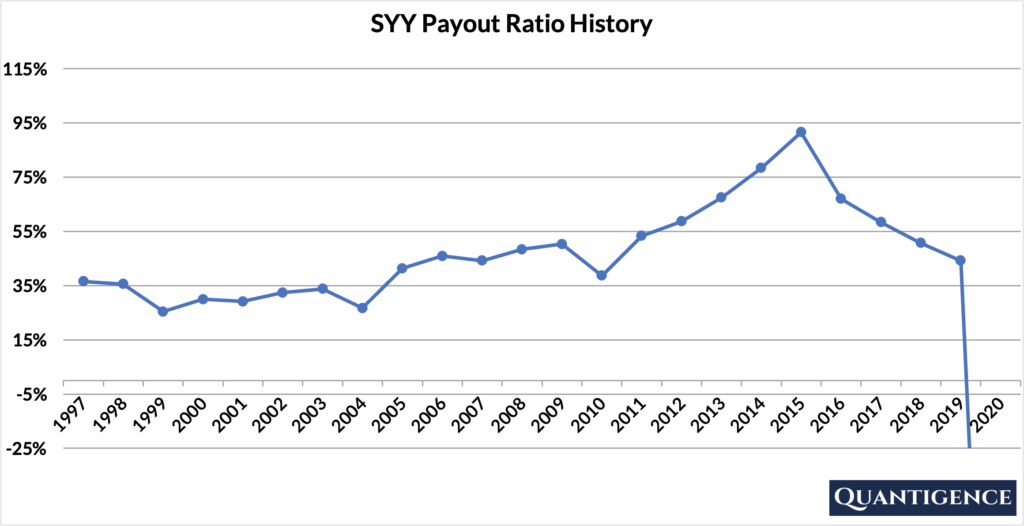

SYY’s Dividend History and Payout Ratio

SYY has an excellent track record of paying and increasing dividends for 51 consecutive years, a record that the company will likely feel highly obligated to maintain. This dividend growth track record makes Sysco a dividend king (a company that has a track record of increasing dividend payouts for more than 50 years), the most prestigious dividend growth category there is.

In 2020, Sysco posted losses because of the impact of COVID-19 and the company’s payout ratio became negative. In the past 23 years, we see a relatively stable dividend payout ratio that always remained below 95%.

When Does SYY Pay Dividends?

SYY pays a quarterly dividend typically announced on varying dates in February, May, August, and November. The ex-dates are in the first week of April, July, October, and January and payments are made in the fourth week of the same months.

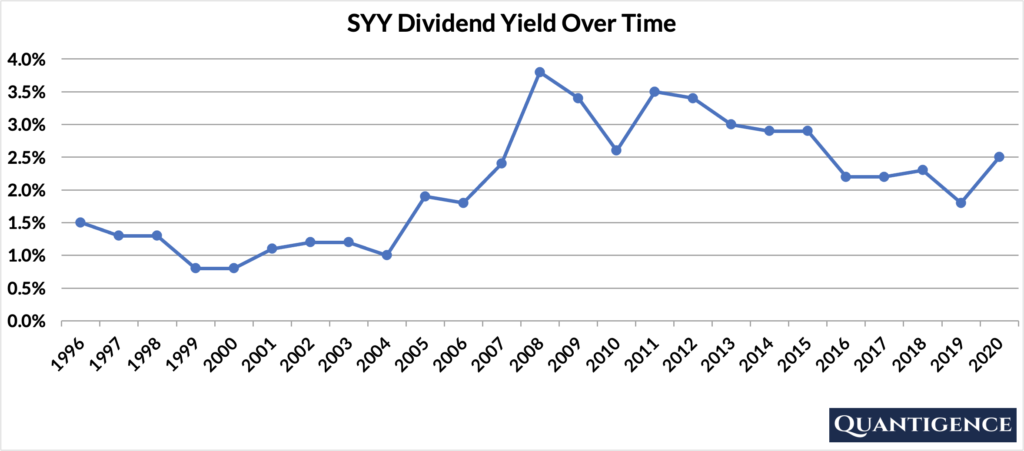

What is SYY’s Dividend Yield?

Dividend yield (the annual dividend paid divided by the share price) shows the 1-year return on a stock purchase in the form of dividends. In 2020, SYY had a dividend yield of 2.5%, higher than our investment universe average of 1.8%. The stock’s historical yield has been moving between 0.8% and 3.8% with an average of 2.1%.

SYY’s Dividend Growth Rate

SYY has grown its dividend payout by an average of 6.0% every year for the past 10 years. However, that growth seems to be accelerating lately with the annual dividend increase averaging 8.4% over the last five years. Below you can see the effect a 10-year growth rate of 6.0% has on SYY’s dividend assuming a starting yield of 2.5%.

| Years | Dividend Growth | Yield Calculation | Yield % |

| Year 0 | 0% | 2.50% | 2.5% |

| Year 1 | 6.00% | 2.5%*1.06 | 2.65% |

| Year 2 | 6.00% | 2.5%*(1.06)^2 | 2.81% |

| Year 3 | 6.00% | 2.5%*(1.06)^3 | 2.98% |

| Year 4 | 6.00% | 2.5%*(1.06)^4 | 3.16% |

| Year 5 | 6.00% | 2.5%*(1.06)^3 | 3.35% |

| Year 6 | 6.00% | 2.5%*(1.06)^6 | 3.55% |

| Year 7 | 6.00% | 2.5%*(1.06)^7 | 3.76% |

| Year 8 | 6.00% | 2.5%*(1.06)^8 | 3.98% |

| Year 9 | 6.00% | 2.5%*(1.06)^9 | 4.22% |

| Year 10 | 6.00% | 2.5%*(1.06)^10 | 4.48% |

If you bought SYY at a yield of 2.5%, an average 10-year dividend growth of 6.0% would mean your yield would be 4.48% 10 years from now. This is called “yield on cost,” and shows the yield we’re receiving on the original amount of money we invested.

How Strong is SYY’s Dividend?

When evaluating dividend stocks, we use our own methodology which is based on Q-scores which consist of seven factors:

- Years paying and increasing dividends

- Market cap

- International sales

- Yield

- Payout ratio

- Five-year dividend growth rate

- Ten-year dividend growth rate

We calculate each of these factors and summarize them in a final proprietary Q-score. To learn more about how we calculate Q-scores, check out our piece on “7 Factors Used to Select Dividend Growth Stocks.”

The Q-score for Sysco Corporation is presently 10.7 which ranks the company as 12th out of 14 stocks in the consumer staples sector. We reward SYY for its outstanding dividend growth track record. The company’s five-year dividend growth rate and yield are also relatively high, so they contribute to SYY’s overall Q-score a significant amount. The company’s size, international sales, and 10-year dividend growth rate are mediocre, and its payout ratio receives a penalty (having paid 2020 dividends from losses).

With many better options to choose from in the company-rich “Consumer Staples” sector, we do not include Sysco in our 30-stock dividend growth portfolio.

[optin-monster slug=”ziwrnabndtepsyq0fyai”]