Dividend growth investing (DGI) is an optimal investing strategy to achieve financial independence and early retirement. That’s because it delivers growing income streams that outpace inflation so that your quality of life actually gets better over time. While less glamorous than “finding the next Microsoft,” or day trading stocks and derivatives, a DGI strategy has one great benefit: it works.

Over the many years we’ve spent working in the finance industry, we’ve learned the gospel truth that most financial pundits won’t tell you. Getting rich is a long, boring, drawn out process. We also learned that you need money to make money. For example, we bought shares in Google when they first had their IPO and we’re still not retired. That’s because at the time, we didn’t have much money to invest. In order to accumulate the kind of wealth you can retire on, you need a stable and consistent rules-based strategy that takes human emotion out of the equation. Acting on fear or greed is the quickest way to losing your shirt. We learned that the hard way, and we’re not sorry for it. Experience is the best teacher.

In a nutshell, DGI is a dividend growth strategy that invests in stocks with a long track record of paying and increasing their dividends. DGI investors accumulate wealth in their dividend growth portfolio and receive growing passive income streams from the quarterly dividend payouts. A long-term view and regular monthly investments will reward dividend growth investors with a steadily increasing income stream over time.

Is Dividend Growth Investing Worth It?

The short answer is yes. Here are four reasons why a DGI strategy is optimal to achieve financial goals over the long term.

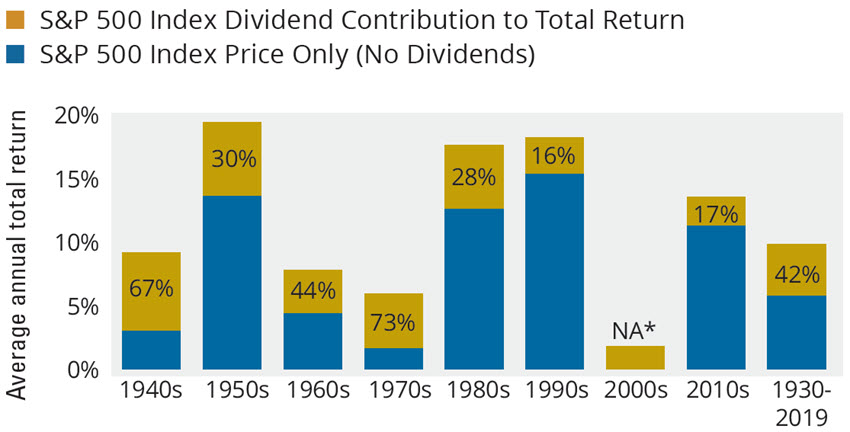

1. Dividends Make Up a Large Part of Long-Term Market Returns

Most investors think of share price growth as the underlying goal of investing. News outlets continuously talk about the rapid growth of successful technology companies, and many retail investors are piling into the so-called FAANG stocks (Facebook, Amazon, Apple, Netflix, and Google). Less newsworthy, but equally important, is the fact that over the long term, dividends were responsible for 42% of the returns for the S&P 500. Dividends, combined with the price appreciation of “stable and boring” dividend paying stocks, account for more than half of all returns for the S&P 500 during the period 1930-2019.

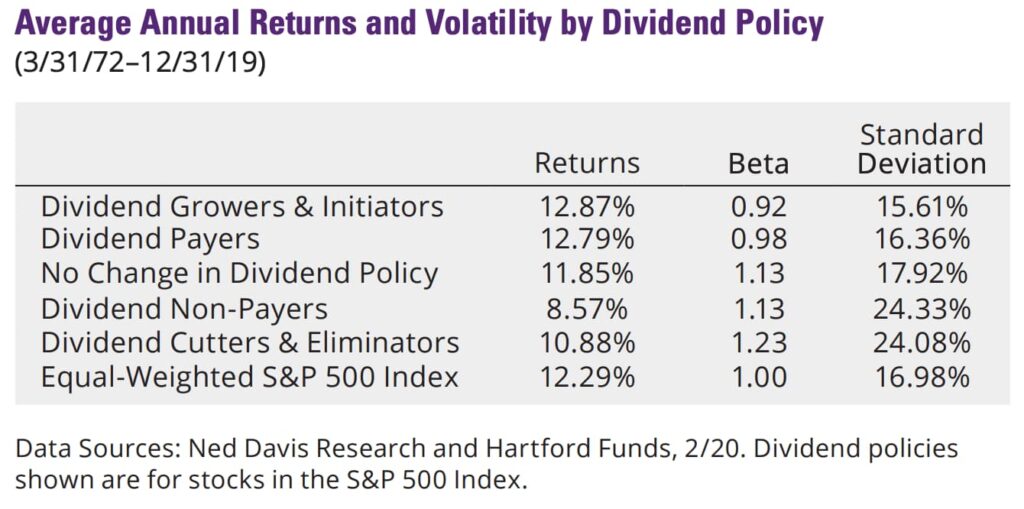

2. Dividend Growth Stocks Have Outperformed the Broad Market Over Time

The below table, published by Hartford Funds, shows how companies that pay dividends outperformed the S&P 500 index during the period between 1972 and 2019. Not only did these companies outperform the broad market benchmark, but they did so with less risk (in other words, less volatility). If we look at companies that increased their dividend payment from one year to the next for any given year, this subset outperformed to an even greater extent, with even less risk.

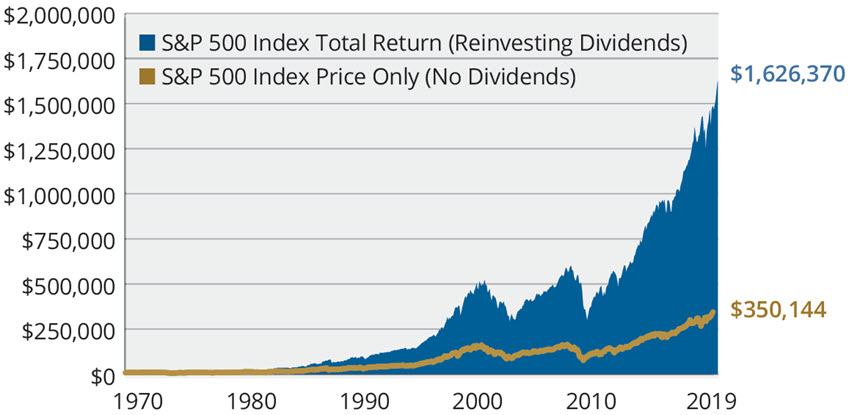

3. Reinvested Dividends Achieve Exponential Growth

If a DGI investor reinvests their dividend income (also called a dividend reinvestment plan or DRIP), these reinvested dividends greatly accelerate the accumulation of wealth. The below chart shows the performance effect of reinvesting dividends versus simple price performance over the past 50 years for the S&P 500.

4. Price Movements of Dividend Growth Stocks Do Not Affect the Payout of the Portfolio

As a dividend growth investor, you’re not interested in short-term stock price fluctuations. Instead, you’re looking for a stable quarterly dividend payment that increases every year. We cannot stress enough how important it is to focus on the growth at which the dividend increases as opposed to the stock price. When you own shares in Johnson & Johnson (JNJ), a company that’s been paying and increasing its dividend payouts to investors for 57 years, you expect the company to continue to do so. Stock price movements become irrelevant because:

- If JNJ stock soars, your investment appreciates, and you’re happy. You still keep getting the quarterly dividend based on the number of stocks you hold and not based on the stock price, and this is what matters. The benefit of capital appreciation is only applicable if you sell the stock, something a dividend growth investor avoids doing.

- If JNJ stock crashes (it never does though), you can purchase future dividend payouts cheaper. Essentially, you get the same future payouts at a discount.

As a dividend growth investor, you don’t care if stocks rise or fall, you only care about those dividend checks increasing every year. What’s most important to DGI investors is the ability for companies to continue paying and increasing dividends over time.

The Risks of Dividend Growth Investing

A DGI strategy almost sounds too good to be true. What are the risks embedded in such a strategy? The primary risk embedded in a DGI strategy is the possibility that a dividend growth stock either stops increasing dividends, or stops paying dividends altogether.

These risks can be mitigated by choosing dividend growth companies that have the highest probability of perpetuating their dividend increases. Dividend yield, dividend growth rate, and dividend payout ratio are all metrics that help investors assess the quality of a DGI stock. When we first created our own dividend growth portfolio many years ago, we couldn’t find an objective selection tool for finding the best dividend growth stocks that were most likely to keep increasing their dividend payments over time. That’s why we created Quantigence – a selection tool and methodology that helps DGI investors choose dividend growth stocks that are best for each investor’s risk appetite, investment horizon, and financial aims.

Next, let’s look at how dividend growth investing works in more detail.