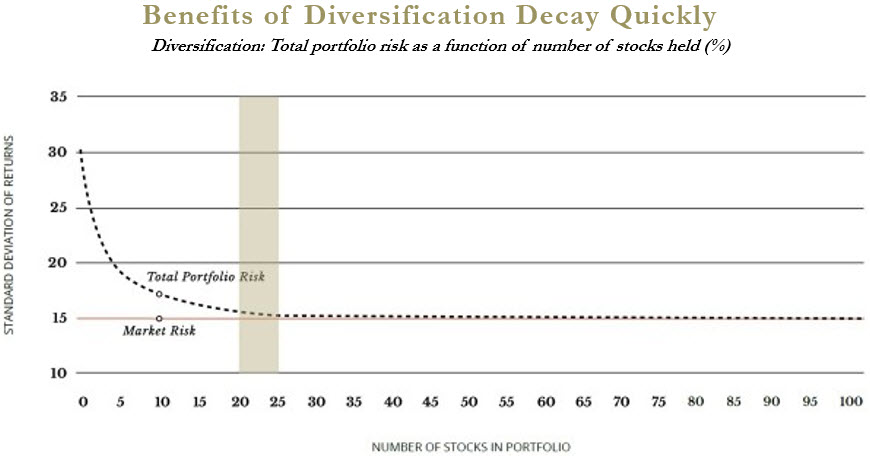

When talking about stocks as an asset class, there’s an often-cited rule – some say a myth – that says you should hold no less than 30 stocks for diversification purposes.

As you can see in the above chart, the optimal number – where portfolio risk approaches market risk – is actually less than 30 stocks. The more stocks you hold, the less your return will deviate from the overall market returns. In other words, the more stocks you hold, the less risk you are taking.

Another way to think about this is the total amount of money you might lose if one of your stocks pulls an Enron. If you’re holding 30 stocks with equal weighting, the maximum drawdown in case of an Enron-like bankruptcy would be 3.33%. Of course, you also need to consider other ways to diversify, like spreading investments in your dividend growth portfolio across different sectors.

Sector Diversification in Your DGI Portfolio

Since the dawn of economics, analysts have been developing models to explain and forecast the behavior of stocks. One of these models is called the multi-factor model. Developed in 1992 by two economists called Fama and French, this type of model explains stock behavior using multiple descriptors common to large groups of stocks called factors. (The Quantigence dividend growth strategy is based on a factor model, using seven factors to forecast the stability of continuously increasing dividend payments.)

One of the most intuitive factors is the sector a company is operating in. In a year of extreme weather where crops are destroyed, stocks of agricultural companies will collectively fall. The freeze in travel since the start of the COVID-19 outbreak decreased demand for fossil fuels, so stocks in the energy sector fell from February through March 2020. When stocks behave similarly, this is referred to as correlation, and it’s why investors should diversify their portfolio across sectors.

Ideally, investors will want to diversify exposure across all available sectors to reduce sector-specific risk. Our universe of 69 dividend growth stocks is not equally distributed across all 11 sectors, and some sectors have better average Q-scores than others. This is where some subjectivity comes into play. If Coca Cola and PepsiCo both have great Q-scores, that doesn’t mean you need to hold them both. You may just choose one, since we can assume drinks companies are correlated (there are even correlations within sectors, but that’s a story for another day).

Diversification Is a Choice Between Risk and Return

In the Coca Cola versus PepsiCo example, there is no right answer. The choice of which stock to hold – or even perhaps, both – depends on each investor’s risk appetite. The ability to compare stocks within industries, or even across industries, is where our Q-score calculator comes in handy. Using our Quantigence Q-score calculator, Quantigence Premium subscribers can:

- View Q-scores for the entire Quantigence universe

- View Q-score contribution for each of the seven factors for each dividend growth stock

- Filter for specific sectors and Quantigence factors

Selecting Your Final Portfolio Holdings

Selecting the final holdings in your DGI portfolio is an iterative process because not all sectors have lots of dividend champions to choose from. It’s helpful to have someone walk you through the process of putting together a dividend growth portfolio, and we’re in a great position to do that. We’ve invested the majority of our own capital in a dividend growth portfolio of stocks -it’s called The Quantigence Dividend Growth Portfolio.

When deciding how many stocks to include in our portfolio, we chose to hold exactly thirty DGI stocks at all times. We feel it’s a nice round number that keeps company-specific risk to a reasonable minimum.

We then moved on to analyze every one of the 11 sectors individually. Ideally, we’d like to have about the same number of stocks from each of the 11 sectors – 2.7 stocks on average. Of course that’s not possible because some sectors only contain one or two stocks. That’s why it’s an ideal, not a reality.

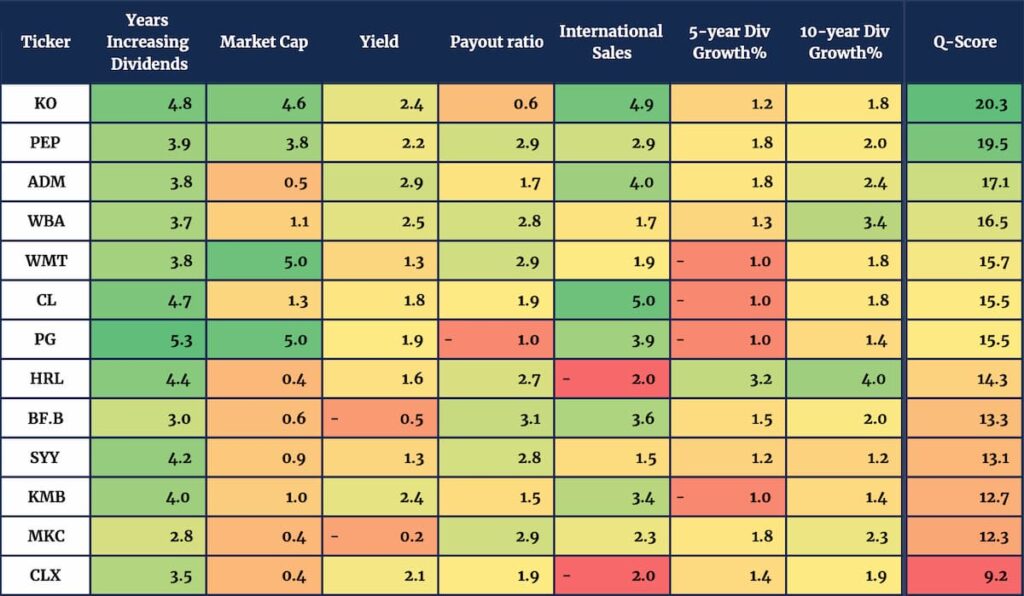

Here’s an example of all the Q-scores for all the companies in our universe that fall into the “Consumer Staples” sector.

Consumer staples is considered a defensive sector – that is, it performs well when everything else goes awry. That’s because no matter what happens, people still need to buy bog rolls and rice. At the top of the above table, we see Coca Cola (KO), one of the most notorious dividend growth stocks out there and one that helped make Warren Buffet a rich man. (Mr. Buffet now receives a yield of more than 60% on his original investment just because of dividend growth.) The next stock on the list is PepsiCo (PEP), a company that shares some similarities with Coca Cola. (For the sake of diversification, you may want to choose one or the other, but not both.) The third stock in the list is Archer Daniel Midlands (ADM), an agriculture firm that transports food – largely in commodity form – across the globe.

The consumer staples sector contains so many good names that we’ve actually chosen five stocks to include in our own Quantigence Dividend Growth Portfolio of 30 dividend growth stocks. If you’d like us to walk you through the steps we took to construct our real-life DGI portfolio, you’ll need to download our premium report – Quantigence – A Guide to Dividend Growth Investing.

In the above report, we’ll walk you through each sector and show you which stocks we selected and why. We’ll then show you exactly how we calculate scores based on the underlying data we’ve licensed from a major provider of financial data. It’s just one of the benefits you’ll get when you become a Quantigence Premium subscriber. Anyways, enough of the sales pitch. Where were we? Ah yes, we were talking to you about how you can construct your own DGI portfolio using our Q-score calculator.

We showed you the Q-scores for the consumer staples sector, and there are Q-scores for all remaining ten sectors as well. Your final stock selection will depend on your own views and risk appetite. There are no hard rules here. If your investment objective is to increase expected return through increased dividend income, you can bias the portfolio towards high dividend yield stocks, or increase concentration by building a dividend growth portfolio with fewer than 30 stocks.

If you’re looking to select only the best dividend paying stocks, you can disregard sector diversification altogether, and simply choose the stocks with the highest Q-scores. (Not recommended.) If you’re more risk averse than we are, you can increase the number of stocks you’re holding up to 69 – the entirety of the Quantigence investment universe.

Weighting Your Final Portfolio Holdings

After you have a final list of stocks you’d like to include in your DGI portfolio, the only thing that remains is determining how to weight them. We believe equal weighting is the easiest and most diverse method of weighting the stocks in your DGI portfolio. This means we simply invest the exact same amount into each of our holdings, arriving at 3.33% for each dividend champion if your portfolio contains 30 stocks.

Equal weighting is not only the easiest way to manage your portfolio, it’s also been shown to outperform other market cap-based and price-based weighting strategies often used by fund managers. If you’re proficient in finance, here is a study that demonstrates the superiority of equal weighting using simulation as well as real-world data from 1926 to 2014.

Once you’ve built your portfolio, you’ll then need to maintain it. What happens if a stock stops paying dividends? What happens when there’s a merger or acquisition? These are all things we cover in our premium report – Quantigence – A Guide to Dividend Growth Investing. Access to that report is restricted to Quantigence Premium subscribers who will also receive the below additional benefits with their subscription.

- Access to all the additional features of our Q-score calculator, including:

- Dividend champions with a market cap of less than $10 billion

- Dividend contenders: dividend growth stocks that have kept increasing dividends for more than ten years but haven’t reached champion status yet

- Dividend challengers: dividend growth stocks that have kept increasing dividends for more than five years but haven’t reached contender status yet

- All eleven sectors

- Foreign stocks

- Premium weekly articles which teach you more about dividend growth investing along with analysis and commentary on our own DGI stocks

- Additional features we’re currently working on such as dividend alerts

As a dividend growth investor, you’ll find Quantigence an invaluable tool to assist you in building and managing your dividend growth portfolio and achieving financial independence. It’s all available for the price of a Starbucks coffee every month. Subscribe to the full Quantigence Premium offering today.