Quantigence is a dividend growth investing strategy that helps investors select the best dividend growth stocks.

Guide to Dividend Growth Investing

Quantigence provides an objective, rules-based method to construct a portfolio of stocks that are resilient in the face of recessions and provide superior returns when compared to the broader market.

Using Quantigence, you can identify stocks across various industries that perform well in both bull and bear markets. You could say it’s an entirely new asset class. Sleep well at night with Quantigence.

Q-Score Calculator

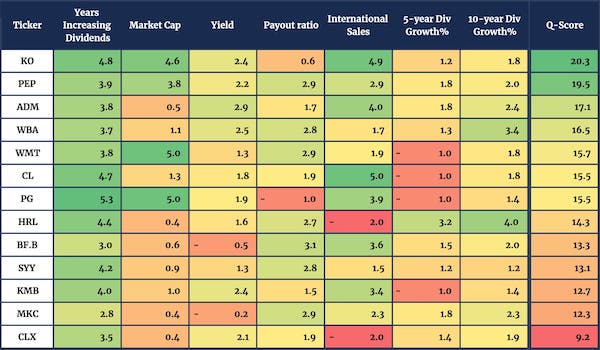

Developed over the past decade by investment professionals, our Calculator calculates proprietary Q-Scores for each dividend growth stock in our coverage. Using these Q-Score values, the quality of dividend growth stocks can be measured and compared across the board.

Our Own Dividend Growth Portfolio

Quantigence Premium subscribers get access to our own dividend growth portfolio that we’ve built and maintain ourselves. In this report, we take you through our portfolio construction process step by step to arrive at the final proprietary portfolio we’re investing in.

Investor Updates

Learn about the intricacies and challenges of dividend growth investing in our weekly blog posts. We analyze strategies, DGI stocks, corporate events, and market movements.

About Us

The strategy was developed over the past decade by risk-averse investment professionals who were looking for a passive income strategy to help them achieve financial independence.